- Access Controls

Security measures designed to restrict or allow access to resources, ensuring that only authorized individuals can view or use specific data or systems.

- Access to Information Act

A Canadian law that provides the public with the right to access information held by government institutions, promoting transparency and accountability.

- Accountability

The obligation of individuals or organizations to account for their activities, accept responsibility, and disclose results transparently.

- Accounting Controls

Mechanisms and procedures designed to ensure the accuracy, completeness, and reliability of financial reporting and to safeguard assets.

- Accounting Standards

Guidelines and rules set by authoritative bodies to ensure the consistency, reliability, and comparability of financial statements and accounting practices.

- Accounts Payable

Money a company owes to suppliers for goods or services received but not yet paid for, recorded as a liability on the balance sheet.

- Accounts Receivable

Money owed to a company by its customers for goods or services delivered but not yet paid for, recorded as an asset on the balance sheet.

- ACL Analytics

Audit, risk, and compliance software used for data analysis, continuous monitoring, and forensic investigation, providing tools for identifying anomalies, detecting fraud, and ensuring data integrity.

- Administrative Controls

Policies and procedures that manage the operational efficiency and compliance of an organization, including documentation, reporting, and procedural guidelines.

- Advanced Analytics

Sophisticated techniques and methods used to analyze complex and large datasets, including predictive modeling, machine learning, and data mining, to uncover insights, patterns, or trends for decision-making purposes.

- After-sales Service

Support provided to customers after a purchase, including warranty services, maintenance, and handling of returns or complaints.

- Agile Auditing

Audit methodology emphasizing flexibility, collaboration, and iterative processes to adapt quickly to changes, improve efficiency, and address emerging risks or priorities.

- Agile Practices

Specific activities, tools, or rituals adopted in agile project management, such as daily stand-up meetings, sprint planning, retrospectives, and user stories, to facilitate teamwork, communication, and delivery excellence.

- Agile Principles

Guiding values and beliefs underlying agile methodologies, emphasizing customer collaboration, iterative development, self-organization, and responsiveness to change to deliver value and achieve success in projects.

- Agile Techniques

Methods, approaches, or practices used in agile project management to plan, execute, and deliver projects iteratively and incrementally, promoting adaptability, collaboration, and customer satisfaction.

- AI Technologies

Technologies that simulate human intelligence, such as machine learning, natural language processing, and computer vision to perform tasks, solve problems, and make decisions autonomously.

- Amortization

The gradual reduction of a debt or intangible asset value over a fixed period through scheduled payments or systematic write-offs.

- Analytical Techniques

Methods, procedures, or approaches used to interpret and analyze data systematically, including statistical analysis, data mining, trend analysis, or predictive modeling, to uncover patterns, trends, or relationships.

- Analytical Tools

Software programs or applications used to analyze, process, and visualize data, providing capabilities for statistical analysis, data mining, visualization, and reporting to derive insights and support decision-making.

- Anomalies

Irregularities, deviations, or unexpected patterns observed in data that do not conform to normal or expected behaviour, indicating errors, inconsistencies, or potential issues requiring further investigation or analysis.

- Anti-bribery Measures

Policies and measures implemented to prevent offering, giving, receiving, or soliciting anything of value to influence the actions of an official or other person in charge of a public or legal duty.

- Application Controls

Controls specific to individual software applications that ensure the completeness, accuracy, authorization, and validity of data processing and transactions.

- Asset Management

The systematic process of developing, operating, maintaining, and disposing of assets cost-effectively to maximize their value and efficiency.

- Asset Tracking

Monitoring and recording the location, usage, and status of an organization's assets to ensure accurate management and security.

- Asset Valuation

Determining the current worth of a company's assets for financial reporting, investment analysis, and risk assessment purposes.

- Asset Verification

The process of confirming the existence, condition, and ownership of an organization's assets to ensure accurate financial reporting.

- Assurance Services

Independent evaluations provided by internal auditors to assess the effectiveness of governance, risk management, and control processes within an organization.

- Attribute Standards

Focus on the qualities of internal audit activities and individuals performing audits, ensuring professionalism and competence in internal auditing.

- Audit Committee

A subcommittee of the board of directors responsible for overseeing the financial reporting process, audit process, internal controls, and compliance with laws and regulations.

- Audit Communication

The process of sharing audit findings, conclusions, and recommendations with stakeholders to ensure transparency, understanding, and action.

- Audit Conclusions

Final assessments and judgments made by the auditor based on the audit findings and evidence, determining the overall effectiveness of controls.

- Audit Documentation

The records and workpapers created during an audit to support the auditor's findings, conclusions, and audit report, ensuring a clear trail of evidence.

- Audit Effectiveness

The extent to which an audit achieves its objectives, including identifying risks, evaluating controls, and providing actionable recommendations for improvement.

- Audit Efficiency

Ratio of outputs or results achieved to inputs or resources consumed in an audit, indicating the productivity, cost-effectiveness, and timeliness of audit activities and processes.

- Audit Evidence

Information collected by auditors during an audit to support their findings and conclusions, including documents, records, observations, and testimonies that validate the accuracy of financial statements.

- Audit Execution

The phase in which auditors carry out the audit plan, including gathering evidence, testing controls, and performing audit procedures.

- Audit Findings

Results or issues identified by auditors during the audit process, including any discrepancies, risks, or weaknesses in internal controls, which are communicated to management and stakeholders.

- Audit Management Software

Software solutions designed to streamline and automate audit processes, including planning, scheduling, documentation, workflow management, and reporting, enhancing efficiency, collaboration, and compliance in audit engagements.

- Audit Methodology

The systematic approach and procedures used by auditors to conduct an audit, ensuring consistency, reliability, and accuracy in their findings.

- Audit Objectives

Specific goals that an audit aims to achieve, such as evaluating the effectiveness of controls, ensuring compliance, and identifying areas for improvement.

- Audit Opinion

The auditor's formal statement regarding the accuracy and fairness of an organization's financial statements, based on the audit findings.

- Audit Plan

A comprehensive strategy and set of procedures developed by auditors to conduct an audit effectively, outlining the scope, objectives, timing, and resources required for the audit.

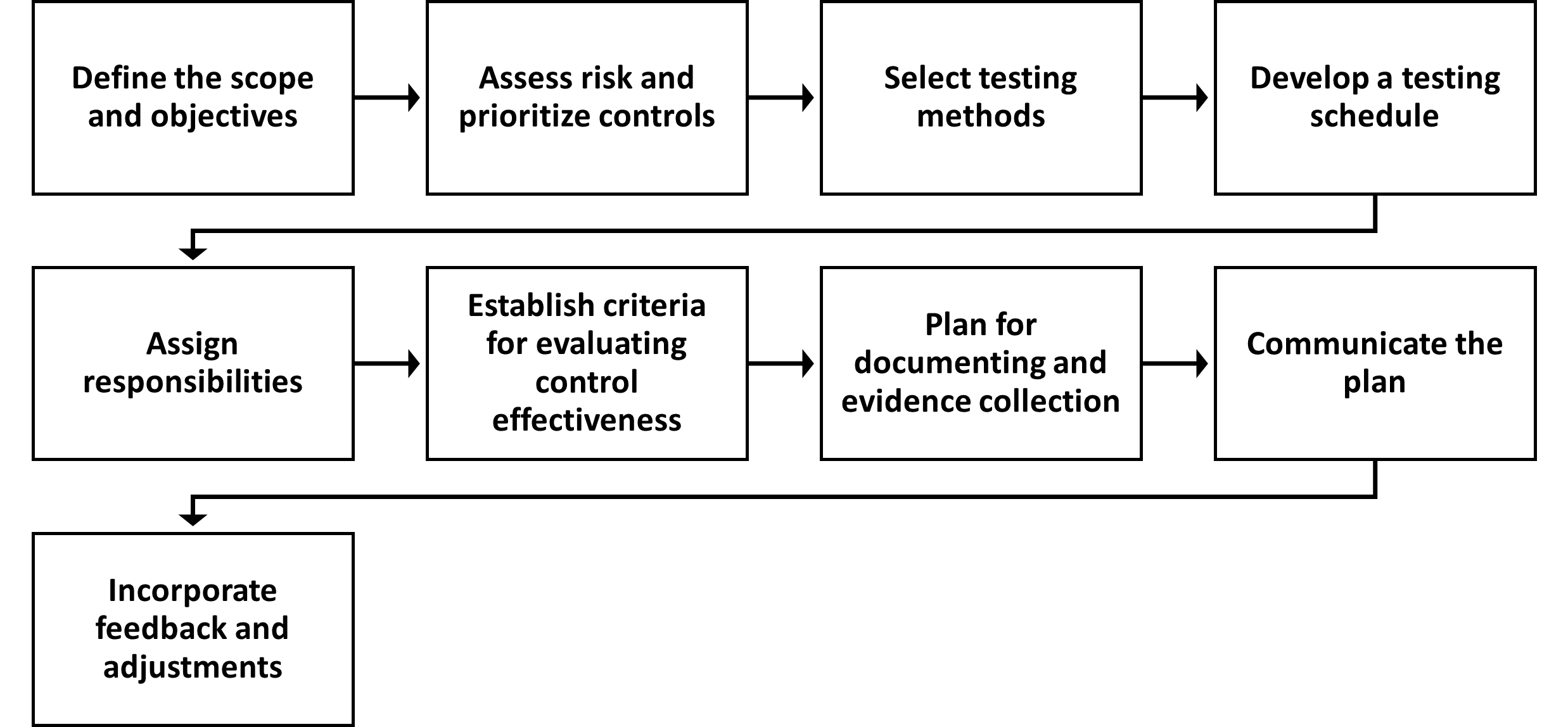

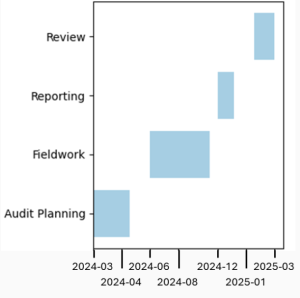

- Audit Planning

The phase of an audit where objectives, scope, and resources are determined, and a strategy is developed to guide the audit process effectively.

- Audit Procedures

Specific tasks and techniques used by auditors to gather evidence, evaluate controls, and test the accuracy and completeness of financial statements.

- Audit Process

Systematic approach and procedures followed in conducting audit engagements, including planning, execution, reporting, and follow-up, to assess controls, risks, and compliance in organizations effectively and efficiently.

- Audit Programs

Detailed plans outlining the specific procedures and tests to be performed during an audit to achieve the audit objectives efficiently and effectively.

- Audit Quality

The degree to which an audit complies with auditing standards and provides assurance that financial statements are accurate, complete, and free from material misstatement.

- Audit Recommendations

Suggestions made by the auditor to improve processes, controls, or compliance based on the findings and conclusions of the audit.

- Audit Report

A formal document summarizing the audit findings, conclusions, and recommendations, communicated to management, the board, and other stakeholders.

- Audit Reporting

Communication of audit results, findings, and recommendations to stakeholders through formal documents, reports, or presentations, facilitating transparency, accountability, and decision-making in organizations.

- Audit Scope

The boundaries of an audit, defining the areas, processes, and period to be covered during the audit.

- Audit Software

Computer applications designed to assist auditors in conducting audits, including tools for data analysis, documentation, and reporting.

- Audit Standards

Established guidelines and principles that govern the auditing process, ensuring consistency, reliability, and quality in audit practices.

- Audit Tasks

Specific activities or actions performed during an audit engagement, such as gathering evidence, testing controls, or documenting findings to assess compliance, risks, or operational effectiveness.

- Audit Techniques

Specific methods and procedures used by auditors to gather evidence, evaluate controls, and assess the accuracy and completeness of financial statements.

- Audit Tool Customization Process

The process of tailoring audit software and tools to meet the specific needs and requirements of an audit engagement, enhancing efficiency and effectiveness.

- Audit Tools

Instruments and software used by auditors to facilitate the audit process, including data analysis, documentation, and reporting.

- Audit Workflow

Sequence of tasks, activities, or steps involved in conducting an audit engagement, including planning, fieldwork, testing, reporting, and follow-up, ensuring systematic and effective completion of audit objectives.

- Auditor General

The official responsible for auditing government departments and public sector organizations, providing independent assessments of financial and operational performance.

- Auditor Independence

The freedom from influences that could compromise an auditor's impartiality and unbiased judgment during the audit process.

- Authorization

The process of granting permission for actions, ensuring that transactions and activities are approved by individuals with the appropriate authority.

- Automated Control

Controls performed by automated systems or software applications, designed to consistently enforce control procedures without human intervention.

- Automation

The use of technology to perform tasks with minimal human intervention, increasing efficiency, accuracy, and consistency in processes.

- AWS

Amazon Web Services, a cloud computing platform providing a wide range of services and solutions for computing, storage, networking, databases, machine learning, and analytics on a pay-as-you-go basis.

- Backlog

List or repository of tasks, features, or user stories prioritized for implementation in a project or sprint, serving as a dynamic and evolving roadmap for development or improvement efforts.

- Backup Procedures

The processes and methods used to create copies of data to ensure its availability and recovery in the event of data loss or system failure.

- Balanced Scorecard

A strategic management tool that translates an organization's vision and strategy into specific, measurable objectives across four perspectives: financial, customer, internal processes, and learning and growth.

- Benchmarking

The process of comparing an organization's processes, performance metrics, and practices against industry standards or best practices to identify improvement areas.

- Benefits Administration

Managing employee benefits programs, including health insurance, retirement plans, and other perks, to support employee well-being and satisfaction.

- Benefits Compliance

The review and evaluation of an organization's employee benefits programs to ensure they meet legal standards and are administered fairly and accurately.

- Benford's Law

A mathematical principle stating that in many naturally occurring datasets, the leading digit is more likely to be small, often used in fraud detection.

- Best Practices

Proven methods or techniques that consistently show superior results, used as benchmarks to improve organizational processes and performance.

- Big Data

Extremely large data sets that can be analyzed computationally to reveal patterns, trends, and associations, especially relating to human behavior and interactions.

- Blockchain

A decentralized digital ledger technology that records transactions across many computers securely, making the data tamper-resistant and transparent.

- Blockchain Auditing

The examination of blockchain systems and transactions to verify their accuracy, security, and compliance with regulatory and organizational standards.

- Board of Directors

A group of individuals elected by shareholders to oversee the activities and governance of an organization, ensuring accountability and strategic direction.

- Budget Allocations

The distribution of financial resources among various departments, programs, or activities within an organization based on priorities and goals.

- Budgetary Control

The process of managing an organization's financial resources by comparing actual expenditures against budgeted amounts to ensure fiscal discipline.

- Business Continuity

The process of creating systems and plans to ensure that essential business functions can continue during and after a disaster or disruption.

- Business Continuity Planning

Strategies and procedures developed to ensure that essential business functions continue during and after a disaster or significant disruption.

- Capital Expenditure

Funds used by a company to acquire, upgrade, and maintain physical assets such as property, industrial buildings, or equipment.

- CAS

Canadian Auditing Standards, which provide guidelines for auditors in Canada to ensure consistency and quality in auditing practices.

- CaseWare IDEA

Data analysis software used for auditing, fraud detection, and data analytics, offering tools for data visualization, manipulation, and extraction from various sources for investigative purposes.

- Cash Audits

Conducting periodic reviews and checks of cash transactions and balances to ensure accuracy, detect discrepancies, and prevent fraud.

- Cash Collection

The process of managing the receipt of payments from customers to ensure timely cash inflows and maintain liquidity.

- Cash Concentration

Aggregating cash from various accounts into a central account to improve control and optimize fund usage.

- Cash Disbursement

The process of managing the outflow of cash to pay suppliers, creditors, and other obligations while optimizing cash flow.

- Cash Flow Forecasting

Predicting the inflows and outflows of cash within a specified period to manage liquidity and plan for surplus or deficit positions.

- Cash Flow Management

The process of monitoring, analyzing, and optimizing the net amount of cash receipts and disbursements over a specific period to maintain liquidity.

- Cash Flow Planning

Forecasting and managing the inflows and outflows of cash to ensure sufficient liquidity to meet short-term obligations and strategic goals.

- Certified Internal Auditor (CIA)

A globally recognized certification for internal auditors, signifying expertise, professionalism, and adherence to the Institute of Internal Auditors' standards.

- Change Management

The process of controlling and managing changes to IT systems and software, ensuring that changes are tested, approved, and documented to prevent disruption and maintain system integrity.

- Charitable Status

The designation given to organizations that operate for charitable purposes, allowing them to receive tax-deductible donations and grants.

- Checklists

Predefined lists of items or procedures that auditors use to ensure all necessary steps are completed and all relevant areas are covered.

- Chief Audit Executive (CAE)

The senior executive responsible for managing the internal audit function, ensuring its effectiveness and alignment with organizational objectives.

- Cloud Computing Audits

Evaluations of cloud service providers and users to ensure compliance with security standards, data protection regulations, and service level agreements.

- COBIT framework

A comprehensive framework for managing and governing enterprise IT, providing principles and practices for IT management and control.

- Code of Ethics

Outlines principles of integrity, objectivity, confidentiality, and competency, guiding the ethical behavior and decision-making of internal auditors.

- Compensating Control

A control designed to compensate for the deficiencies in other controls, reducing the overall risk to an acceptable level.

- Compensation Management

The process of designing and administering pay structures, salaries, bonuses, and incentives to attract and retain talent.

- Compliance

Adherence to laws, regulations, guidelines, and specifications relevant to an organization's operations, ensuring legal and ethical integrity.

- Compliance Audit

An audit that assesses whether an organization is adhering to regulatory requirements, internal policies, and procedures to ensure compliance.

- Compliance Checks

The process of reviewing and verifying that an organization's operations, processes, and practices adhere to internal policies and external regulations.

- Compliance Framework

A structured set of guidelines and practices designed to ensure that an organization adheres to legal, regulatory, and internal policy requirements.

- Compliance Monitoring

The ongoing process of ensuring that an organization adheres to legal, regulatory, and policy requirements through regular reviews and audits.

- Compliance Program

A set of internal policies and procedures implemented by an organization to ensure adherence to laws, regulations, and ethical standards.

- Compliance Reporting

The process of documenting and submitting required information to regulatory bodies to demonstrate adherence to laws, regulations, and standards.

- Compliance Risks

The potential for legal or regulatory sanctions, financial loss, or damage to reputation that an organization may suffer due to its failure to comply with laws and regulations.

- Compliance Standards

Established criteria and guidelines that organizations must follow to adhere to legal, regulatory, and industry-specific requirements.

- Computer Vision

Field of AI and computer science focused on developing systems that can interpret and analyze visual information from images or videos, enabling applications such as object recognition and image classification.

- Confidence Intervals

A range of values derived from sample data that is likely to contain the true population parameter, expressed with a certain level of confidence.

- Confidential Reporting

Channels that enable individuals to report concerns or misconduct anonymously, ensuring the protection of their identity and preventing potential retaliation.

- Confidentiality

Ensuring that information is accessible only to those authorized to have access, protecting sensitive data from unauthorized disclosure.

- Conflict of Interest

A situation where a person or organization has competing interests or loyalties that could influence their decision-making.

- Consulting Services

Advisory activities provided by internal auditors to help improve an organization's operations and address specific issues or challenges.

- Continuous Auditing

A method that uses technology to perform audit-related activities on a continuous basis, providing real-time assurance over business processes.

- Continuous Feedback

Ongoing communication and input provided to individuals or teams on their performance, actions, or outcomes, facilitating learning, improvement, and adaptation in real-time or at regular intervals.

- Continuous Improvement

The ongoing effort to enhance products, services, or processes by making incremental changes over time to increase efficiency and quality.

- Continuous Monitoring

The ongoing process of collecting and analyzing data to detect and respond to risks, ensure compliance, and improve processes in real time or near real time.

- Contract Amendments

Changes or additions made to an existing contract to modify its terms, conditions, or scope of work.

- Contract Compliance

Ensuring that all parties involved in a contract adhere to the agreed terms, conditions, and regulatory requirements.

- Control Activities

Policies, procedures, and practices that ensure management directives are carried out to achieve organizational objectives and mitigate risks.

- Control Assessment

The process of evaluating the adequacy and effectiveness of controls implemented to mitigate risks and achieve organizational objectives.

- Control Deficiency

A weakness in the design or operation of a control that does not allow management to prevent or detect misstatements on a timely basis.

- Control Design

The process of developing control activities that effectively mitigate risks and support the achievement of organizational objectives.

- Control Environment

The set of standards, processes, and structures that provide the foundation for carrying out internal controls across the organization.

- Control Implementation

The process of putting control activities into practice to mitigate identified risks and achieve organizational objectives.

- Control Monitoring

Ongoing evaluations to ensure that control activities are functioning as intended and deficiencies are addressed in a timely manner.

- Control Processes

Procedures and mechanisms implemented to ensure the integrity of financial reporting, compliance with laws, and effective operations.

- Control Self-assessment (CSA)

A system through which internal control effectiveness is evaluated by employees who are involved in the processes, providing insight into risk management.

- Core Principles

Fundamental principles within the IPPF that include integrity, objectivity, confidentiality, and competency, guiding the professional conduct of internal auditors.

- Corporate Culture

The shared values, beliefs, and behaviours that shape how employees interact and work within an organization, influencing its overall environment and effectiveness.

- Corporate Governance

The system of rules, practices, and processes by which a company is directed and controlled, focusing on the interests of stakeholders and ensuring accountability.

- Corporate Social Responsibility (CSR)

Business practices involving initiatives that benefit society, focusing on environmental sustainability, social equity, and economic development.

- Corrective Action Plans

Steps proposed by auditors and agreed upon by management to address identified issues and improve processes, controls, or compliance.

- Corrective Actions

Steps taken to fix identified problems, deficiencies, or non-conformities to prevent their recurrence and improve processes or systems.

- Corrective Controls

Measures implemented to correct identified issues or deficiencies in internal controls, ensuring that errors or irregularities are addressed and prevented from recurring.

- Corrective Measures

Actions taken to address and rectify identified deficiencies or issues, ensuring that errors or irregularities are corrected and prevented from recurring.

- COSO Framework

A model for evaluating internal controls, developed by the Committee of Sponsoring Organizations of the Treadway Commission, used to enhance organizational performance.

- Cost Analysis

The process of evaluating costs associated with a business activity or a decision to determine the activity's financial viability and optimize resource use.

- Cost Efficiency

The measure of how well an organization uses its financial resources to achieve its goals, minimizing costs while maintaining quality and performance.

- Crisis Management

Strategies and procedures for dealing with unexpected and disruptive events, ensuring effective communication and decision-making to protect an organization's interests.

- Cultural Shift

Transformation or evolution of organizational values, beliefs, norms, or behaviours over time, leading to a new cultural identity, mindset, or way of operating that aligns with strategic objectives.

- Customer Satisfaction Auditing

The assessment of customer feedback and satisfaction levels to identify areas for improvement in products, services, and customer relations.

- Customer Support

Assistance provided to customers before, during, and after a purchase to ensure a satisfactory experience and resolve any issues or questions.

- Cyber Threats

Potentially malicious activities or attacks aimed at damaging, disrupting, or gaining unauthorized access to computer systems, networks, or data.

- Cybersecurity

The practice of protecting systems, networks, and programs from digital attacks to ensure data integrity, confidentiality, and availability.

- Cybersecurity Auditing

The process of evaluating an organization's cybersecurity measures, including policies, controls, and practices, to ensure they protect against cyber threats and data breaches.

- Daily Stand-up Meetings

Brief, time-bound meetings held by agile teams, usually at the start of each workday, to synchronize activities, discuss progress, address obstacles, and plan for the day's tasks collaboratively.

- Data Analysis

The process of examining, cleaning, transforming, and modeling data to discover useful information, draw conclusions, and support decision-making.

- Data Analytics

The process of examining data sets to draw conclusions, identify patterns, and support decision-making using statistical and computational techniques.

- Data Analytics Skills

Proficiency in using analytical tools, techniques, and methodologies to interpret and analyze data, extract insights, and make informed decisions, essential for professionals in various fields, including auditing and business analytics.

- Data Analytics Tools

Software applications or platforms used to analyze, process, and visualize data, providing capabilities for data mining, statistical analysis, visualization, and reporting to derive insights and support decision-making.

- Data Backup

The process of creating copies of data to protect against loss or corruption, ensuring that data can be restored in the event of an accidental deletion, hardware failure, or disaster.

- Data Collection

Process of gathering, acquiring, or retrieving data from various sources, systems, or documents, ensuring completeness, accuracy, and relevance for analysis, reporting, or decision-making purposes.

- Data Encryption

The process of converting data into a coded format to prevent unauthorized access, ensuring data confidentiality and security during transmission and storage.

- Data Entry Validation

Techniques used to ensure the accuracy and integrity of data entered into a system by checking for errors, omissions, and inconsistencies.

Process of retrieving or pulling data from various sources, systems, or databases for analysis, reporting, or storage purposes, ensuring accuracy, completeness, and timeliness of data.

- Data Governance

Framework of policies, procedures, and controls governing the management, usage, and integrity of data assets within an organization, ensuring compliance, security, and quality standards.

- Data Integrity

The accuracy, consistency, and reliability of data throughout its lifecycle, ensuring it is not altered or corrupted and remains trustworthy.

- Data Patterns

Regular or recurring structures, trends, or relationships observed within datasets, indicating systematic behaviours, correlations, or associations that can be analyzed for insights or predictions.

- Data Preparation

Activities and processes performed to organize, clean, transform, or format raw data into a structured and usable format for analysis, ensuring consistency, integrity, and compatibility with analytical tools.

- Data Privacy

Ensuring that personal data is collected, processed, and stored in a manner that protects the privacy rights of individuals and complies with regulations.

- Data Privacy Measures

Controls, policies, and practices implemented to safeguard personal or sensitive information from unauthorized access, use, or disclosure, ensuring compliance with privacy regulations and protecting rights of individuals.

- Data Protection

Measures and processes implemented to safeguard personal and sensitive data from unauthorized access, alteration, or destruction, ensuring data integrity and security.

- Data Quality

Measure of the accuracy, completeness, consistency, and reliability of data, ensuring it meets the requirements of intended uses and supports informed decision-making and analysis.

- Data Quality Issues

Problems or deficiencies in data accuracy, completeness, consistency, or reliability, leading to errors, inconsistencies, or inefficiencies in data analysis, reporting, or decision-making processes within organizations.

- Data Security

Measures and practices implemented to protect digital data from unauthorized access, disclosure, alteration, or destruction, ensuring confidentiality, integrity, and availability of information assets.

- Data Storage

Repository or database used to store, manage, and organize data assets securely, ensuring durability, availability, and scalability to support various applications, users, and business needs effectively.

- Data Trends

Patterns, tendencies, or changes observed over time in datasets, indicating consistent movements, behaviours, or developments that can be analyzed for insights or predictions.

- Data Visualization

Presentation of data in visual formats such as charts, graphs, or dashboards, enhancing understanding, interpretation, and communication of complex information for better decision-making and insights.

- Data Warehouse

Centralized repository or database that stores structured, organized, and integrated data from various sources, enabling analysis, reporting, and decision-making across an organization.

- DEI Initiatives Auditing

The examination of an organization's diversity, equity, and inclusion programs and policies to ensure they are effectively implemented and are achieving desired outcomes.

- Delivery Times

The amount of time taken from the placement of an order to the delivery of the product to the customer, impacting customer satisfaction and operational efficiency.

- Depreciation

The systematic allocation of the cost of a tangible asset over its useful life to account for wear and tear, aging, or obsolescence.

- Descriptive Analytics

Analysis of historical data to understand past events, trends, or patterns, providing insights into what has happened and serving as a basis for further analysis or decision-making.

- Descriptive Statistics

Statistical techniques used to summarize and describe the main features of a data set, including measures of central tendency and variability.

- Detection Methods

Techniques and procedures used to identify and uncover fraudulent activities or discrepancies within an organization's financial records or operations.

- Detection Risk

The risk that the auditors' procedures will not detect a material misstatement that exists in an assertion.

- Detective Controls

Controls designed to identify and correct errors or fraud that have already occurred, such as reconciliations and audits.

- Diagnostic Analytics

Examination of data to identify causes or reasons behind past events or trends, enabling organizations to understand why certain outcomes occurred and informing corrective actions or improvements.

- Digital Transformation

Organizational initiative involving the adoption, integration, and optimization of digital technologies, processes, and culture to fundamentally change business operations, models, and outcomes, driving innovation, growth, and agility.

- Disaster Recovery

Strategies and processes for restoring IT operations and data access after a disruption or disaster to ensure business continuity.

- Disaster Recovery Planning

Developing strategies and procedures to recover and restore critical systems, data, and operations following a significant disruption or disaster.

- Disclosure Controls

Procedures and measures implemented to ensure the accuracy, completeness, and timeliness of information disclosed in financial reports.

- Distribution Efficiency

The optimization of distribution processes to ensure that products are delivered to customers in the most cost-effective and timely manner.

- Diversity and Inclusion

Practices aimed at creating a workplace where diverse perspectives are valued and all employees feel included, respected, and supported.

- Document Review

The process of examining and evaluating documents to ensure they are accurate, complete, and comply with relevant standards and requirements.

- Documentation Standards

Guidelines and procedures for creating, managing, and maintaining records and documents to ensure accuracy, consistency, and compliance with regulatory requirements.

- Donor Funds

Financial contributions received from individuals, organizations, or governments, intended to support specific programs, projects, or general operations of an organization.

- Donor Trust

The confidence that donors have in an organization's ability to use their contributions effectively, ethically, and in alignment with stated goals.

- Effectiveness Metrics

Quantitative measures used to assess the extent to which organizational activities achieve their intended outcomes and contribute to overall goals.

- Efficiency Metrics

Quantitative measures used to evaluate the effectiveness and productivity of organizational processes, activities, or resources in achieving desired outcomes or delivering value efficiently.

- Employee Background Checks

Evaluating a candidate's history, including criminal records, employment history, and qualifications, to ensure suitability for employment.

- Employee Relations

The management of interactions between employers and employees to maintain positive, productive workplace relationships and address conflicts.

- Employee Training

Programs designed to enhance employees' skills, knowledge, and competencies to improve performance and compliance with organizational standards.

- Employee Turnover

The rate at which employees leave an organization and are replaced by new hires, impacting continuity and costs.

- Encryption

The process of converting data into a coded format to prevent unauthorized access, ensuring data confidentiality and security during storage and transmission.

- End-of-period Activities

Procedures performed at the close of an accounting period, such as reconciliations and adjustments, to ensure accurate financial reporting and compliance.

- Enterprise Risk Management (ERM)

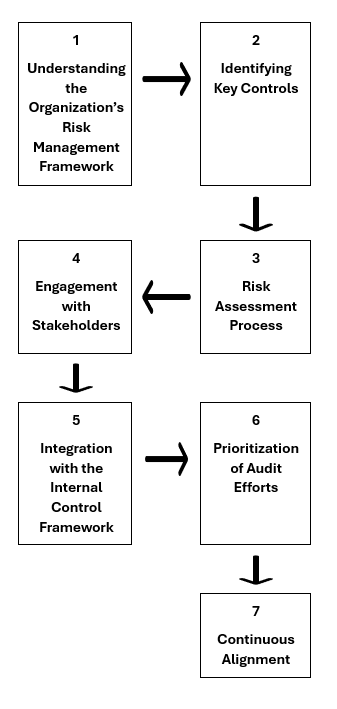

A comprehensive approach to identifying, assessing, managing, and monitoring risks across an organization to maximize value and achieve objectives.

- Environmental Audit

An audit that evaluates an organization's compliance with environmental laws and regulations, and its impact on the environment, promoting sustainable practices.

- Environmental, Social, and Governance (ESG)

Criteria used to evaluate an organization's impact on the environment, social equity, and governance practices, influencing investment and operational decisions.

- Equipment Upgrades

Enhancements or replacements of existing equipment to improve performance, increase efficiency, or integrate new technologies.

- Ethical Considerations

Principles and standards that guide behaviour and decision-making to ensure actions are morally right, fair, and just within the audit process.

- Ethical Culture

The collective practices and attitudes within an organization that promote ethical behaviour and decision-making at all levels.

- Ethical Dilemmas

Situations where a person must choose between conflicting moral principles, often involving a trade-off between ethical standards and personal or organizational goals.

- Ethical Hacking

Authorized testing of computer systems and networks to identify security vulnerabilities, conducted by ethical hackers to improve security measures.

- Ethical Standards

Principles that guide the professional conduct of internal auditors, ensuring actions are performed with integrity, objectivity, confidentiality, and competence.

- Ethics

Moral principles that govern a person's behaviour, guiding internal auditors to act with integrity, fairness, and accountability.

- ETL Processes

Extract, Transform, Load (ETL) processes involve extracting data from multiple sources, transforming it to fit operational needs or analytical requirements, and loading it into a target system or database.

- Evidence Collection

The process of gathering relevant data, documents, and information during an audit to support the evaluation of controls and processes.

- Exception Reporting

The process of identifying and reporting instances where actual performance deviates from expected or predefined standards, highlighting anomalies for investigation.

- Executive Summaries

Concise summaries or overviews of audit reports, highlighting key findings, recommendations, and conclusions for senior management or decision-makers to grasp the essence of the audit findings quickly.

- Expenditure Auditing

The process of reviewing and verifying an organization's expenses to ensure they are legitimate, properly authorized, and recorded accurately.

- Expense Allocation

The process of assigning costs to specific programs, projects, or departments based on usage, benefits received, or other relevant criteria.

- Expense Management

The process of controlling and tracking an organization's expenditures to ensure that they are within budget and aligned with business objectives.

- External Assessment

An independent review evaluating the internal audit activity's conformance with the Standards, typically conducted by qualified external auditors.

- External Audit

Independent examination of financial statements by external auditors to provide an opinion on their accuracy and compliance with accounting standards and regulations.

- Fairness

Treating all stakeholders justly and equitably, ensuring impartiality and non-discrimination in decision-making processes.

- Fieldwork

The phase of the audit where auditors collect evidence, perform tests, and conduct interviews at the client's location to gather information for their audit conclusions.

- Financial Administration Act

A Canadian law that governs financial management, accountability, and control within the federal public administration, ensuring the proper use of public funds.

- Financial Audits

Evaluations of an organization's financial statements and related operations to ensure accuracy, completeness, and compliance with accounting standards.

- Financial Contingency

Funds set aside or plans established to address unexpected financial events or emergencies.

- Financial Controls

Procedures and policies implemented to ensure the accuracy, integrity, and reliability of financial information and to safeguard assets.

- Financial Disclosures

The act of providing financial information and statements to stakeholders, including details on financial performance, position, and operations, to ensure transparency.

- Financial Health

The overall state of an organization's financial situation, including its ability to generate income, manage expenses, and maintain solvency and liquidity.

- Financial Integrity

The accuracy, completeness, and reliability of financial information, ensuring that financial statements are free from material misstatement and reflect the true financial position of an organization.

- Financial Management

The practice of planning, organizing, directing, and controlling an organization's financial activities to achieve financial objectives and ensure stability.

- Financial Oversight

The process of monitoring and managing an organization's financial activities and performance to ensure accuracy, accountability, and adherence to policies and regulations.

- Financial Planning

The process of estimating future financial needs, setting goals, and developing strategies to manage resources effectively and achieve objectives.

- Financial Processes

Procedures and activities related to managing an organization's financial resources, including budgeting, accounting, financial reporting, and internal controls.

- Financial Reporting

The process of producing statements that disclose an organization's financial status to management, investors, and the government, including balance sheets, income statements, and cash flow statements.

- Financial Risks

The possibility of losing money on investments or business operations due to financial market fluctuations or other financial uncertainties.

- Financial Services Auditing

The examination of financial institutions and services to ensure compliance with regulatory standards, accuracy of financial reporting, and effectiveness of internal controls.

- Financial Statements

Records that outline the financial activities and position of an organization, including the balance sheet, income statement, and cash flow statement.

- Firewall Protection

Security systems that monitor and control incoming and outgoing network traffic based on predetermined security rules to block unauthorized access.

- First Line of Defence

The initial layer of risk management responsibilities carried out by operations management, involving the execution and maintenance of internal controls.

- Flowcharts

Diagrams that represent the sequence of processes or systems, used by auditors to understand and analyze workflows and controls.

- Follow-up Audits

Audits conducted after the initial audit to verify that corrective actions have been implemented and are effectively addressing identified issues.

- Forensic Accounting

The practice of using accounting, auditing, and investigative skills to examine financial records and transactions for evidence of fraud or financial misconduct.

- Forensic Auditing

The examination of financial records to detect and investigate fraud, corruption, or financial misconduct, often used in legal proceedings.

- Fraud Detection

The process of identifying and investigating instances of fraud within an organization to prevent financial losses and safeguard assets.

- Fraud Prevention

Measures taken to deter and prevent fraudulent activities within an organization, including internal controls, policies, and procedures.

- Fraud Risks

The potential for loss due to fraudulent activities, including misappropriation of assets, financial statement fraud, and corruption.

- Fraud Schemes

Planned activities designed to deceive and defraud an organization, often involving manipulation of financial statements or misappropriation of assets.

- Fund Accounting

An accounting system used by not-for-profit organizations to track and report on financial resources designated for specific purposes or programs.

- Fundraising

The process of soliciting and gathering voluntary financial contributions from individuals, businesses, foundations, or governmental agencies to support an organization's activities and goals.

- Governance

The system by which organizations are directed and controlled, involving the relationships among the board, management, shareholders, and other stakeholders.

- Governance Frameworks

The system of rules, practices, and processes by which an organization is directed and controlled, ensuring accountability and alignment with strategic goals.

- Governance Policies

Guidelines and rules established by an organization to direct and control its actions, ensuring accountability, fairness, and alignment with its objectives.

- Governance Principles

Fundamental guidelines that inform and direct the governance practices within an organization, ensuring accountability, fairness, and transparency.

- Governance Processes

Systems and procedures through which an organization directs and controls its operations, ensuring alignment with objectives and regulatory requirements.

- Governance Structures

The arrangement of responsibilities and authority among different organizational roles, including the board of directors, management, and stakeholders.

- Governance, Risk Management, and Control (GRC)

An integrated approach to managing an organization's overall governance, risk management, and internal controls to direct, protect, and ensure the achievement of organizational objectives.

- Grant Management

The process of administering and overseeing grant funds, including application, budgeting, compliance, reporting, and evaluation to ensure effective use of resources.

- Health and Safety

Policies, procedures, and regulations implemented to ensure the physical well-being and safety of employees in the workplace.

- Health Compliance

Ensuring that an organization's health policies and practices adhere to relevant laws and regulations to protect employee health and safety.

- Healthcare Auditing

The review of healthcare organizations to ensure compliance with regulatory requirements, accuracy of billing and coding, and effectiveness of patient care practices.

- HR Audit Reporting

The documentation and communication of findings from an audit of human resource practices, policies, and procedures, including recommendations for improvement.

- HR Compliance

Ensuring that human resources policies and practices adhere to labour laws, regulations, and organizational standards.

- HR Compliance Auditing

The review and evaluation of an organization's human resources policies and procedures to ensure they are compliant with laws and aligned with best practices.

- Human Resources

The department responsible for managing employee-related functions, including recruitment, hiring, training, development, and compliance with labour laws.

- Impairment

A permanent reduction in the recoverable amount of a company's asset below its carrying amount, necessitating a write-down in the asset's value.

- Impartiality

The principle of being objective and unbiased, ensuring that decisions and judgments are made without favouritism or prejudice.

- Implementation Guidance

Practical insights and tools provided to help internal auditors apply the Standards effectively in their engagements.

- Incident Management

The process of identifying, analyzing, and responding to incidents to minimize damage and restore normal operations as quickly as possible.

- Incident Response

The organized approach to addressing and managing the aftermath of a security breach or cyberattack to limit damage and restore normal operations.

- Incident Response Plan

A documented strategy detailing the actions to be taken to detect, respond to, and recover from incidents, minimizing impact and restoring normal operations.

- Independence

The freedom from conditions that threaten the ability of internal auditors to carry out their responsibilities in an unbiased manner.

- Independent Auditors

Auditors who are not affiliated with the organization being audited, ensuring objectivity and impartiality in the evaluation of financial statements and controls.

- Industry Benchmarks

Standards or points of reference derived from industry best practices used to compare and measure an organization's performance against its peers.

- Information and Communication

Systems and processes that support the capture, exchange, and dissemination of information needed to manage and control operations effectively.

- Information Integrity

Ensuring that data is accurate, consistent, and reliable throughout its lifecycle, preventing unauthorized alterations or corruption.

- Information Security

Measures taken to protect an organization's information systems from unauthorized access, use, disclosure, disruption, modification, or destruction.

- Infrastructure Management

The administration of essential IT components, including hardware, software, networks, and facilities, to ensure optimal performance and reliability.

- Inherent Risks

The susceptibility of assertions to material misstatements, assuming there are no related controls, due to the nature of the business or environment.

- Institute of Internal Auditors (IIA)

An international professional association that provides standards, guidance, and certifications for internal auditors to promote the practice of internal auditing.

- Intangible Assets

Non-physical assets that have value, such as patents, trademarks, copyrights, and brand recognition.

- Integrated Audit

An audit that combines financial, operational, compliance, and IT auditing procedures to provide a comprehensive evaluation of an organization's overall control environment.

- Integration of Data Analytics

Incorporation of data analytics capabilities, tools, or processes into organizational systems, operations, or decision-making processes to leverage data-driven insights to improve performance, innovation, and competitiveness.

- Integrity

The quality of being honest and having strong moral principles, ensuring consistency and fairness in actions and decisions.

- Intellectual Property

Creations of the mind, such as inventions, literary and artistic works, and symbols, names, and images used in commerce, protected by law.

- Interim Reports

Periodic or preliminary audit reports issued during the audit engagement, providing updates on audit progress, findings, or issues identified before the final audit report is completed and issued.

- Internal Audit

An independent, objective assurance and consulting activity designed to add value and improve an organization's operations by evaluating risk management, control, and governance processes.

- Internal Audit Charter

A formal document defining the internal audit function's purpose, authority, and responsibility within an organization, approved by senior management and the board.

- Internal Audit Function

The department or team within an organization responsible for performing internal audits to evaluate and improve risk management, control, and governance processes.

- Internal Audit Standards

Professional guidelines established by organizations like the IIA to ensure internal auditors perform their duties with integrity, objectivity, and competence.

- Internal Auditing

An independent, objective assurance and consulting activity designed to add value and improve an organization's operations by evaluating and enhancing risk management, control, and governance processes.

- Internal Auditing Standards

Guidelines that direct the conduct and performance of internal auditing activities, ensuring consistency and quality in internal audits.

- Internal Auditor

A professional who evaluates and improves the effectiveness of risk management, control, and governance processes within an organization.

- Internal Control

Mechanisms, rules, and procedures implemented by a company to ensure the integrity of financial and accounting information, promote accountability, and prevent fraud.

- Internal Control Assessment

The process of evaluating the effectiveness of an organization's internal controls to ensure they are mitigating risks and achieving objectives.

- Internal Control Environment

The organizational framework, including policies, procedures, and attitudes, that influences the effectiveness of internal controls and risk management.

- Internal Controls

Procedures and mechanisms implemented to ensure the integrity of financial reporting, compliance with laws, and effective operations.

- International Professional Practices Framework (IPPF)

A comprehensive framework developed by the IIA providing standards, guidance, and best practices for internal auditors globally.

- Interviewing Techniques

Methods used by auditors to gather information through direct communication with employees and management, helping to understand processes and identify issues.

- Intrusion Detection

Techniques and systems used to monitor network traffic for suspicious activity and detect unauthorized access or breaches in real time.

- Inventory Audits

Periodic checks of inventory records and physical counts to ensure accuracy, detect discrepancies, and verify proper inventory management.

- Inventory Counts

The process of counting and verifying the quantity of items in inventory to ensure accuracy and consistency with inventory records.

- Inventory Management

The process of overseeing and controlling the ordering, storage, and use of a company's inventory to optimize efficiency and reduce costs.

- Inventory Valuation

Determining the value of inventory on hand using methods like FIFO, LIFO, or weighted average to ensure accurate financial reporting.

- Invoice Generation

Creating and issuing invoices to customers for goods or services provided, detailing amounts owed and payment terms.

- Invoice Matching

Comparing purchase orders, receipts, and invoices to verify that the goods or services billed match what was ordered and received.

- IoT Auditing

The process of evaluating the security, functionality, and compliance of Internet of Things (IoT) devices and systems within an organization.

- IT Audit

An audit that evaluates an organization's information systems, IT infrastructure, and related processes to ensure data integrity, security, and alignment with business objectives.

- IT Compliance

Ensuring that information technology systems and practices adhere to legal, regulatory, and organizational policies and standards.

- IT Controls

Procedures and policies implemented to ensure the integrity, confidentiality, and availability of information technology systems and data.

- IT Governance

The framework of policies and practices that ensure IT resources are utilized effectively to achieve business goals and manage IT risks.

- IT Incident Investigation

The process of examining and analyzing IT incidents to determine their cause, impact, and necessary corrective actions.

- IT Infrastructure

Framework of hardware, software, networks, and facilities required to support the operations and activities of an organization's information technology systems and services effectively and efficiently.

- IT Risk Management

The identification, assessment, and mitigation of risks associated with the use of information technology within an organization.

- IT Security

Measures and practices designed to protect information systems from unauthorized access, cyber threats, and data breaches.

- IT Systems

Information technology infrastructure, applications, and components used by organizations to manage, process, store, and disseminate data, supporting business operations, communication, and decision-making processes.

- Iterative Process

Methodology involving repetitive cycles of planning, execution, and evaluation, allowing for incremental improvements, feedback incorporation, and adaptation to evolving requirements or conditions.

- ITIL Framework

A set of best practices for IT service management, focusing on aligning IT services with the needs of the business and improving service delivery.

- Job Analysis

The systematic study of a job to determine its duties, responsibilities, and the qualifications required to perform it, forming the basis for job descriptions.

- Judgmental Sampling

A sampling method where the auditor uses their professional judgment to select sample items based on specific criteria or knowledge.

- Kanban

Lean method for managing and improving work processes, visualizing workflow, limiting work in progress, and optimizing throughput by using visual boards, cards, and continuous feedback.

- Key Performance Indicators (KPIs)

Metrics used to evaluate an organization's success in achieving its strategic and operational goals.

- Key Risk Indicators (KRIs)

Metrics used to measure the potential risks that could impact an organization's ability to achieve its objectives.

- Labour Relations

The management of relationships between employers and employees, including negotiations, collective bargaining, and resolution of workplace disputes.

- Labour Relations Auditing

The review and evaluation of an organization's management of relationships between employers and employees, including negotiations and conflict resolution.

- Legal Compliance

Ensuring that the organization's actions and policies comply with applicable laws and legal requirements.

- Legal Framework

The system of laws and regulations that provide the basis for governance, ensuring that organizational actions comply with legal requirements.

- Liability Management

The process of strategically managing a company's liabilities, including loans and other debts, to optimize the balance between risk and cost.

- Lifecycle Management

Managing the entire lifecycle of a product or asset from acquisition and use to disposal or retirement to maximize value and efficiency.

- Liquidity Management

The process of monitoring and optimizing the availability of cash or easily convertible assets to meet short-term financial obligations.

- Logistics Operations

The management of the flow of goods, information, and resources from origin to consumption, ensuring efficient and effective movement and storage.

- Machine Learning

Subset of artificial intelligence (AI) focused on building systems that learn from data and improve performance over time without being explicitly programmed, enabling predictive analysis and decision-making.

- Maintenance Planning

The process of scheduling and organizing maintenance activities to ensure equipment reliability, operational efficiency, and extended lifespan.

- Manufacturing Auditing

The examination of manufacturing processes and systems to ensure quality control, efficiency, compliance with regulations, and effectiveness of production operations.

- Market Intelligence

The collection and analysis of market data and trends to inform strategic decision-making and maintain competitive advantage.

- Market Research

The process of gathering, analyzing, and interpreting information about a market, including customers' needs and preferences, to inform business decisions.

- Material Misstatement

An error or omission in financial statements that could influence the economic decisions of users based on those statements.

- Material Weakness

A deficiency, or a combination of deficiencies, in internal control, resulting in a reasonable possibility that a material misstatement of the financial statements will not be prevented or detected on a timely basis.

- Materiality

The threshold or magnitude of an omission or misstatement of accounting information that could influence the economic decisions of users.

- Monitoring Activities

Ongoing evaluations to ensure each component of internal control is functioning properly and addressing any identified deficiencies.

- Natural Language Processing

AI technology enabling computers to understand, interpret, and generate human language, facilitating tasks such as sentiment analysis, text summarization, and language translation for various applications.

- Non-statistical Sampling

The use of an auditor's judgment to determine the sample size and select sample items without relying on random selection or probability theory.

- Not-for-profit Auditing

The examination of financial records and operations of not-for-profit organizations to ensure accuracy, compliance, and proper use of funds.

- Objectivity

An unbiased mental attitude that internal auditors must maintain throughout the audit process to ensure credible results.

- Observation Techniques

The practice of auditors directly observing processes, activities, and conditions to gather evidence and assess the effectiveness of controls.

- Obsolescence Risks

The likelihood that an asset or product will become outdated or no longer useful due to technological advancements or market changes.

- Onboarding Auditing

The review of the procedures and processes used to integrate new employees into an organization, ensuring they are effective and aligned with best practices.

- Operating Expense

The day-to-day expenses required for running a business, including rent, utilities, payroll, and maintenance costs.

- Operational Alignment

Alignment of business operations, processes, and resources with organizational goals, strategies, and priorities to enhance efficiency, effectiveness, and overall performance across all functions or departments.

- Operational Audit

An audit that evaluates the efficiency and effectiveness of an organization's operations, processes, and procedures, aiming to improve performance.

- Operational Efficiency

The ability of an organization to deliver products or services in the most cost-effective manner without compromising quality, while maximizing resource utilization.

- Operational Goals

Specific, measurable objectives set by an organization to guide and assess the performance of its operations and achieve strategic aims.

- Operational Improvements

Changes and enhancements made to processes, systems, or practices to increase efficiency, effectiveness, and overall performance.

- Operational Process Mapping

The visual representation of an organization's processes, identifying each step and its interactions to improve understanding and efficiency.

- Operational Processes

The series of activities and tasks performed within an organization to produce goods or deliver services efficiently and effectively.

- Operational Risks

The potential for loss resulting from inadequate or failed internal processes, people, systems, or external events impacting an organization's operations.

- Order Fulfillment

The complete process from receiving a customer order to delivering the product or service, ensuring customer satisfaction.

- Order Tracking

Monitoring the status and location of orders from placement through delivery to ensure timely fulfillment and accurate record-keeping.

- Orientation

The introduction of new employees to their job, colleagues, and the organization's culture, policies, and procedures to help them acclimate and perform effectively.

- Output Controls

Measures and procedures to ensure that the data produced by a system is accurate, complete, and authorized, maintaining the integrity of the information output.

- Outsourced Operations

Business processes or services contracted out to third-party providers to enhance efficiency, reduce costs, and allow focus on core activities.

- Payment Collection

The process of receiving payments from customers for goods or services sold, ensuring timely cash inflows.

- Payroll Compliance

The process of ensuring that an organization's payroll practices adhere to relevant laws, regulations, and internal policies to avoid penalties and discrepancies.

- Payroll Management

The administration of an organization's employee compensation, including wages, salaries, bonuses, deductions, and the maintenance of payroll records.

- Peer Reviews

The evaluation of an audit firm's or auditor's work by other professionals in the field to ensure adherence to professional standards and quality.

- Penetration Testing

A simulated cyber attack on a system to identify vulnerabilities and test the effectiveness of security measures, also known as ethical hacking.

- Pension Plans

Retirement plans funded by employers, employees, or both, providing periodic payments to employees upon retirement based on predefined benefits.

- Performance Assessment

The evaluation of an individual's or organization's work performance against established standards and objectives to identify strengths and areas for improvement.

- Performance Audits

Assessments of an organization's processes, programs, or activities to determine their efficiency, effectiveness, and economy.

- Performance Indicators

Metrics used to measure the efficiency, effectiveness, and success of an organization's activities in achieving its strategic and operational goals.

- Performance Management

The continuous process of identifying, measuring, and developing employee performance in alignment with the organization's strategic goals.

- Performance Metrics

Quantitative measures used to assess the efficiency and effectiveness of an organization's activities, processes, or employees.

- Performance Monitoring

Continuously tracking and assessing the efficiency and effectiveness of processes or activities to ensure they meet set objectives and standards.

- Performance Reporting

The process of documenting and communicating an organization's progress toward achieving its goals and objectives, using various metrics and indicators.

- Performance Standards

Criteria for executing internal auditing engagements, including planning, performing, and reporting, to ensure effectiveness and efficiency.

- Personal Information Protection and Electronic Documents Act (PIPEDA)

The Personal Information Protection and Electronic Documents Act, a Canadian law regulating the collection, use, and disclosure of personal information by private sector organizations.

- Physical Controls

Security measures designed to protect an organization's physical assets, including locks, security systems, and access controls to prevent unauthorized access or theft.

- Physical Security Measures

Measures designed to protect an organization's physical assets, facilities, and personnel from unauthorized access, theft, damage, or other physical threats.

- Planning Phase

The initial stage of an audit where objectives are defined, scope is determined, and strategies and resources are allocated.

- Policy Compliance

Adherence to established guidelines, procedures, or regulations within an organization, ensuring that activities align with the legal and regulatory framework.

- Population Characteristics

The attributes and features of a population, such as size, demographics, and behaviour, used to understand and analyze the group as a whole.

- Power BI

Microsoft's business analytics tool that enables users to visualize and analyze data from various sources, create interactive reports, and share insights for informed decision-making.

- Practice Guides

Detailed guides on conducting specific internal audit activities, providing methodologies, best practices, and examples to assist internal auditors.

- Predictive Analytics

Analysis of historical and current data using statistical models and algorithms to forecast future outcomes, trends, or behaviours, enabling proactive decision-making and risk mitigation strategies.

- Predictive Models

Statistical or machine learning models used to forecast future outcomes or trends based on historical data and patterns, enabling proactive decision-making and risk mitigation strategies.

- Prescriptive Analytics

A type of data analysis that not only anticipates what will happen but also recommends actions to achieve desired outcomes or to manage potential future scenarios by using algorithms, simulations, optimization techniques, etc., to suggest specific actions based on data analysis and predictions.

- Preventive Controls

Controls designed to prevent errors or fraud from occurring in the first place, such as authorization and segregation of duties.

- Privacy Act

Legislation that governs the collection, use, and disclosure of personal information by government agencies, ensuring the protection of an individual's privacy rights.

- Process Automation

The use of technology to perform tasks without human intervention, increasing efficiency and accuracy in processes and operations.

- Process Efficiency

The measure of how well a process converts inputs into outputs, focusing on minimizing waste and optimizing resource utilization.

- Process Improvement

The systematic approach to enhancing business processes to achieve more efficient results, reduce costs, and improve quality and performance.

- Process Optimization

Systematic approach to improving processes, workflows, or systems to enhance efficiency, quality, and performance by identifying and eliminating inefficiencies, bottlenecks, or waste using analytical methods.

- Process-based Audit

An audit approach that examines the processes within an organization to ensure they are efficient, effective, and aligned with strategic goals.

- Procurement Processes

The procedures and activities involved in acquiring goods and services, from identifying needs and selecting suppliers to managing contracts and evaluating performance.

- Professional Competence

The ability and skill of an individual to perform their professional duties effectively, maintaining relevant knowledge and adhering to standards.

- Professional Development

Activities and programs designed to enhance the skills, knowledge, and competencies of professionals, ensuring they remain current in their field.

- Professional Judgment

Decision-making based on expertise, experience, ethics, and relevant facts, allowing auditors to assess situations, make informed conclusions, and exercise discretion in audit engagements.

- Professional Skepticism

An attitude that includes a questioning mind and a critical assessment of audit evidence, considering the possibility of misstatement or fraud.

- Professionalism

The conduct, aims, or qualities that characterize or mark a profession or professional person, ensuring integrity, competence, and ethical behaviour in the workplace.

- Program Effectiveness

The extent to which a program achieves its intended outcomes and goals, demonstrating the success and impact of its activities.

- Program Efficiency

The measure of how well a program uses its resources to achieve its objectives, minimizing waste and maximizing output.

- Public Consultation

The process of seeking feedback and input from the public on specific issues, policies, or projects to inform decision-making and ensure community needs and perspectives are addressed.

- Public Engagement

The process of involving the public in organizational decision-making and activities to build trust, gather input, and ensure that public interests are considered.

- Public Interest

The welfare and well-being of the general public, considered in decision-making processes to ensure actions benefit society as a whole.

- Public Sector Auditing

The review and evaluation of government and public sector entities to ensure accountability, transparency, and efficient use of public resources.

- Public Trust

The confidence that the public has in the integrity and effectiveness of public sector organizations and their management of resources.

- Purchase Order Approval

The process of reviewing and authorizing purchase orders to ensure they are accurate, necessary, and within budget before committing funds.

- Quality Assurance

A systematic process of checking to see whether a product or service being developed is meeting specified requirements, ensuring consistency and quality.

- Quality Assurance and Improvement Program (QAIP)

A program to assess the effectiveness and efficiency of internal audit activities, ensuring continuous improvement and adherence to standards.

- Quality Control

The operational techniques and activities used to fulfill quality requirements, including testing and inspections to ensure products or services meet standards.

- Questionnaires

Structured sets of questions used by auditors to gather information from employees and management about processes, controls, and risks.

- Random Sampling

A sampling method where each item in the population has an equal chance of being selected, ensuring unbiased representation of the population.

- Ratio Analysis

The use of financial ratios to evaluate relationships between different financial statement items, assessing an organization's performance, liquidity, and solvency.

- Real-time Auditing

Audit approach using technology and automation to collect, analyze, and report on audit data continuously and instantly, enhancing agility, efficiency, and responsiveness in auditing processes.

- Real-time Data

Data that is captured, processed, and made available immediately or without significant delay, enabling timely analysis, decision-making, and response to changing conditions or events.

- Real-time Insights

Immediate, up-to-date information or analysis derived from data, processes, or events, providing timely and actionable intelligence for decision-making, problem-solving, and performance improvement in organizations.

- Real-time Monitoring

The continuous observation and analysis of systems, processes, or activities as they occur, allowing for immediate detection and response to issues.

- Receipt Inspection

Examining delivered goods to ensure they meet quality and quantity specifications before acceptance and payment.

- Recommendations

Suggestions made by auditors to improve processes, controls, or compliance based on the findings and conclusions of the audit.

- Reconciliation

The process of comparing and verifying records to ensure accuracy and consistency, typically involving matching internal records with external statements or accounts.

- Recruitment

The process of identifying, attracting, and hiring qualified candidates for job vacancies within an organization.

- Recruitment Auditing

The examination of an organization's hiring processes to ensure they are effective, fair, and compliant with relevant regulations and standards.

- Regression Analysis

A statistical method for estimating the relationships among variables, often used to make predictions or assess the impact of one variable on another.

- Regulatory Compliance

Adhering to laws, regulations, and guidelines set by external authorities to ensure legal and ethical business operations.

- Regulatory Reporting

The submission of required information to regulatory authorities to demonstrate compliance with laws, regulations, and industry standards.

- Regulatory Standards

Requirements set by governmental or regulatory bodies that organizations must follow to ensure legal and ethical business practices.

- Reporting Phase

The stage in an audit where findings are documented, conclusions are drawn, and recommendations are communicated to stakeholders through an audit report.

- Resource Allocation

Allocation and distribution of resources, such as personnel, funds, or equipment, to activities, projects, or tasks based on priorities, requirements, and availability to optimize utilization and achieve objectives.

- Resource Optimization