Business Fundamentals, 1st Edition Copyright © 2025 by Kerri Shields is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

Business Fundamentals, 1st Edition Copyright © 2025 by Kerri Shields is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

1

Business Fundamentals is an all-encompassing introductory textbook designed to introduce readers to the business world. Geared toward college and university students, especially those with little to no prior experience in business, this resource lays a strong foundation for individuals embarking on their academic journey with ambitions of pursuing a business career.

The book delves into key functional areas of business, illustrating how departments within organizations work together to generate sales, boost revenue, manage finances, develop innovative products and services, attract and retain customers, manage resources, and make sound decisions. It also addresses essential topics such as corporate social responsibility, business ethics, teamwork, risk management, personal finance, and strategies for academic and professional achievement. Furthermore, it provides an introduction to entrepreneurship and highlights the pivotal roles of managers and leaders in business operations.

Tailored for first-year students, the text includes Canadian-specific insights on economics and banking while maintaining a global outlook with examples from Canada, the United States, and other countries. By blending content from various open educational resources (OERs) with original material, this textbook offers a thorough and engaging overview of the business field.

My varied experiences throughout my career have provided me with insights in many industries, companies, and job roles. Some of the positions I have held include the following:

The variety of job roles I have held and the variety of business projects I have completed have permitted me to gain knowledge and skills from many different types of businesses. I have a keen understanding of business practices, operations management, project management, customer service, marketing practices, tracking revenue and expenses, starting an online business, and how global business in conducted.

I hope you find this OER book interesting and helpful. I will try my best to update it from time to time.

Sincerely,

Kerri Shields

Below is a record of edits and changes made to this book since its initial publication. Whenever edits or updates are made in the text, a record and description of those changes will be noted here. The edition number will only change when there is a major update to the book. The ancillary files (i.e., test bank, slides) that accompany this book always reflect the most recent version.

| Date of Publication | Edition | Revisions |

|---|---|---|

| January 2, 2025 | Business Fundamentals, 1st Edition |

|

Chapter Features and Bloom’s Taxonomy

eCampusOntario is a provincially-funded non-profit organization that leads a consortium of the province’s publicly-funded colleges, universities, and indigenous institutes to develop and test online learning tools to advance the use of education technology and digital learning environments.

This textbook is part of the eCampusOntario open textbook library, which provides free learning resources in a wide range of subject areas. These open textbooks can be assigned by instructors for their classes and can be downloaded by learners to electronic devices. These educational resources are customizable to meet a wide range of learning needs.

If you decide to adopt this book for a course or training program (or other) please report your adoption at the eCampus website. eCampusOntario is keen to report students’ savings and connect with successful OER adopters.

Every attempt has been made to make this OER accessible to all learners and compatible with assistive and adaptive technologies. The Pressbooks content management system was chosen for its commitment to built-in accessibility. The Web version of this resource has been designed to meet accessibility requirements under the Accessibility for Ontarians with Disabilities Act (AODA) and in the Web Content Accessibility Guidelines (WCAG 2.1). In addition to the web version, additional files are available in a number of file formats including PDF, EPUB (for eReaders), and Course Cartridge (for LMS).

If you are having problems accessing this resource, please contact kshields@centennialcollege.ca. Please include the following information: The location of the problem by providing a web address or page description. A description of the problem. The computer, software, browser, and any assistive technology you are using that can help us diagnose and solve your issue (e.g., Windows 10, Google Chrome (Version 65.0.3325.181), NVDA screen reader)

Each chapter has been evaluated using WAVE® and modified as needed to meet zero errors in accordance with WCAG AA. “WAVE® is a suite of evaluation tools that helps authors make their web content more accessible to individuals with disabilities. WAVE can identify many Web Content Accessibility Guideline (WCAG) errors, but also facilitates human evaluation of web content. Our philosophy is to focus on issues that we know impact end users, facilitate human evaluation, and to educate about web accessibility.”

This book is compiled through combining various chapters of different OERs to obtain much of each chapter’s content, although, new content has been added throughout and many statistics, charts, references, and examples have been updated for currency. Thank you to all those who contributed to the open educational resource platforms thereby creating a wealth of information and learning tools.

| Book Chapter | Adaptations from OER Sources | Level 1 Chapter Headings |

|---|---|---|

| Cover Page | Photograph by Ricky Esquivel | Pexels | URL: https://www.pexels.com/photo/high-rise-building-1662159/ | Cover Page |

| Chapter 1 | N/A | N/A |

| Chapter 2 | “Foundations of Business” in NSCC Fundamentals of Business Copyright © 2021 NSCC Edition by NSCC, Pamplin College of Business and Virgina Tech Libraries is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. | The Apple World of Business |

| Chapter 2 | “The Nature of Business” in Introduction to Business Copyright © 2023 Web Edition by OpenStax is licensed under Creative Commons Attribution License v4.0, except where otherwise noted. | Economic Benefits When Businesses Earn Profits Factors of Production: The Building Blocks of Business |

| Chapter 2 | “Teamwork in Business” in Fundamentals of Business Copyright © 2022 by Florence Daddey and Rachael Newton is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. | Business Participants, Stakeholders, and Functional Areas of Business Group Cohesion Factors that Erode Team Performance |

| Chapter 2 | “Foundations of Business” and “Teamwork in Business” in Fundamentals of Business: Canadian Edition Copyright © 2018 (Canadian Edition) by Pamplin College of Business and Virgina Tech Libraries is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. | Team Roles Blocking Roles H5P Class Team Projects Team Contract H5P |

| Chapter 3 | “Management and Leadership in Today’s Organizations” in Introduction to Business Copyright © 2023 by OpenStax is licensed under Creative Commons Attribution License v4.0 | Four Functions of Management Planning, Organizing, Leading |

| Chapter 3 | “Governance Board Membership” in Indigenous Lifeways in Canadian Business Copyright © 2022 by Russell Evans; Michael Mihalicz; and Maureen Sterling is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, except where otherwise noted. | Governance Board Membership |

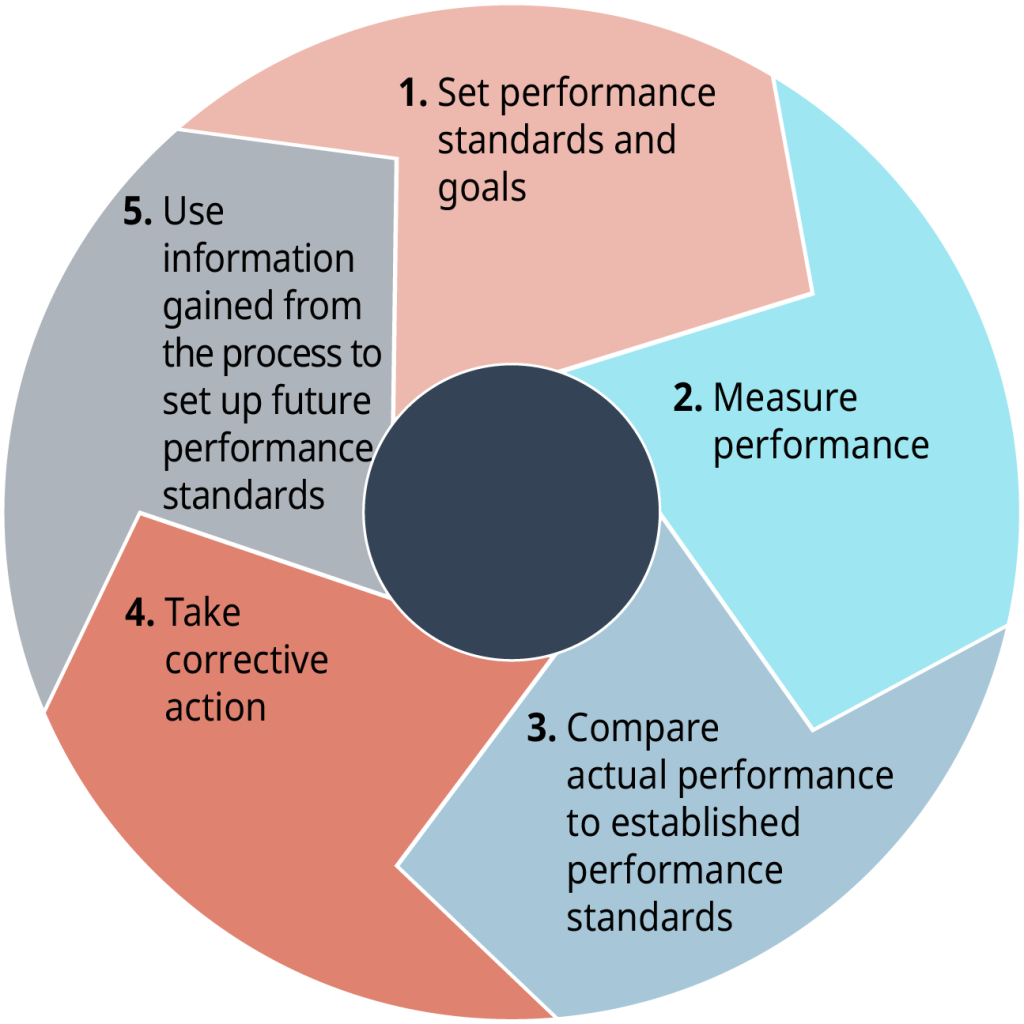

| Chapter 3 | “The Role of Managers” in Fundamentals of Business Copyright © 2022 by Florence Daddey and Rachael Newton is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. | Controlling Managerial Skills SMART Goals A Six-step Approach to Decision Making |

| Chapter 3 | Fundamentals of Business: Canadian Edition Copyright © 2018 (Canadian Edition) by Pamplin College of Business and Virgina Tech Libraries is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. | Motivating Employees |

| Chapter 4 | “New Venture Innovation” in Leading Innovation, 2nd Edition Copyright © 2023 by Kerri Shields is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. | All with some adaptations |

| Chapter 4 | Fundamentals of Business Copyright © 2022 by Florence Daddey and Rachael Newton is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. | Business Structure (partial with adaptations) |

| Chapter 5 | “Indigenous Entrepreneurship” in Indigenous Lifeways in Canadian Business Copyright © 2022 by Russell Evans; Michael Mihalicz; and Maureen Sterling is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, except where otherwise noted. | Indigenous Entrepreneurship: Economic Leakage |

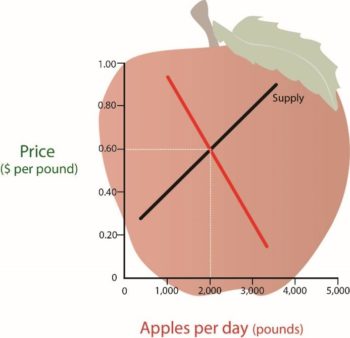

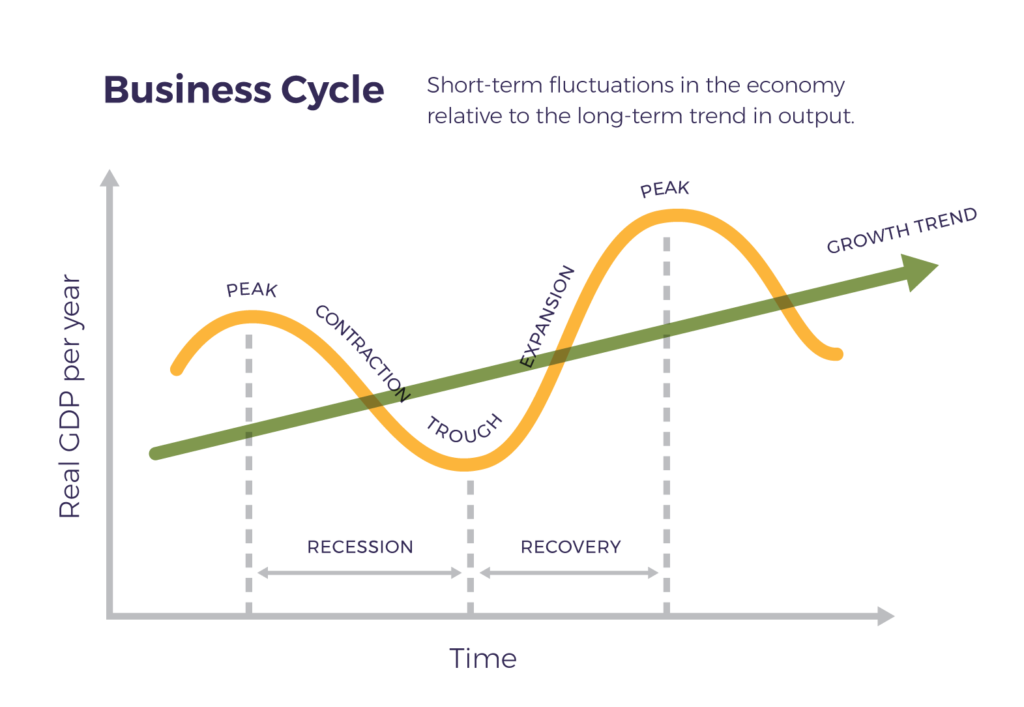

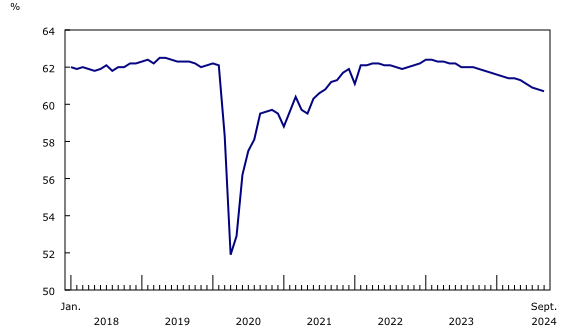

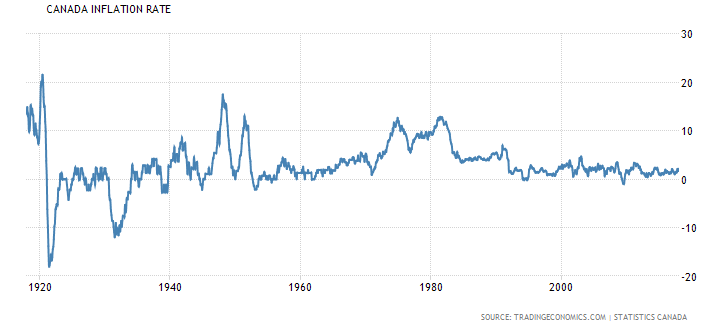

| Chapter 5 | “Economics and Business” and “Money and Banking” in Fundamentals of Business Copyright © 2022 by Florence Daddey and Rachael Newton is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. | All with some adaptations |

| Chapter 6 | Fundamentals of Business, 3rd edition Copyright © 2020 by Stephen J. Skripak and Ron Poff is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. | Personal and Business Ethics (partial with some adaptations) The Individual Approach to Ethics (partial with some adaptations) |

| Chapter 6 | Ethics and Social Responsibility Copyright © 2024 by Business Faculty from Ontario Colleges and eCampusOntario Program Managers is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. | Corporate Social Responsibility (CSR) (partial with some adaptations) CSR and Various Stakeholders (partial with some adaptations) Carroll’s Corporate Social Responsibility Pyramid (with adaptations) |

| Chapter 7 | Business in a Global Environment Copyright © 2024 by Business Faculty from Ontario Colleges and eCampusOntario Program Managers is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. | The Globalization of Business Why Do Nations Trade? (partial with some adaptations) The Global Environment (partial with some adaptations) Trade Controls (partial with some adaptations) Reducing International Trade Barriers (partial with some adaptations) |

| Chapter 7 | “Business in a Global Environment” in Fundamentals of Business Copyright © 2022 by Florence Daddey and Rachael Newton is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. | Why Do Nations Trade? (partial with some adaptations) Measuring Trade Between Nations (partial with some adaptations) Opportunities in International Business (partial with some adaptations) |

| Chapter 8 | “Authenticity and Indigenous Products” in Indigenous Lifeways in Canadian Business Copyright © 2022 by Russell Evans; Michael Mihalicz; and Maureen Sterling is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, except where otherwise noted. | Authenticity and Indigenous Products |

| Chapter 8 | Marketing: Providing Value Copyright © 2024 by Business Faculty from Ontario Colleges and eCampusOntario Program Managers is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. | What is Marketing? (with some adaptations) Target Markets (with some adaptations) The Marketing Mix (with some adaptions) |

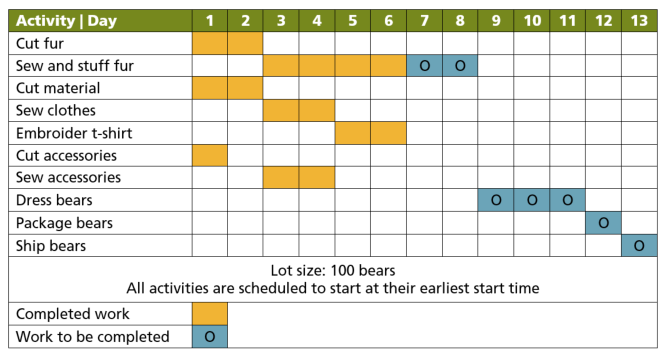

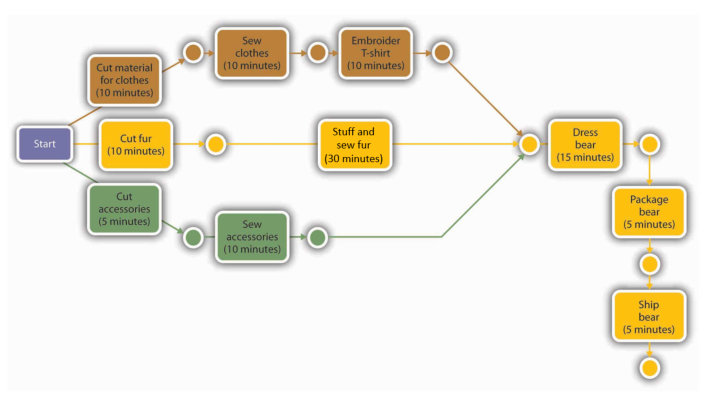

| Chapter 9 | Operations Management Copyright © 2024 by Business Faculty from Ontario Colleges and eCampusOntario Program Managers is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. | Operations Management for Manufacturing (partial with some adaptations) Production Planning (partial with some adaptations) Production Control (partial with some adaptations) Graphical Tools: Gannt and PERT charts Production Process Technologies (with some adaptations) Operations Management for Service Providers (with some adaptations) Producing for Quality (with some adaptations) |

| Chapter 10 | “Overcoming Entrepreneurial Challenges” in Indigenous Lifeways in Canadian Business Copyright © 2022 by Russell Evans; Michael Mihalicz; and Maureen Sterling is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, except where otherwise noted. | Overcoming Entrepreneurial Challenges: Financing |

| Chapter 10 | “Accounting and Financial Information” in Fundamentals of Business, 3rd edition Copyright © 2020 by Stephen J. Skripak and Ron Poff is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. | The Role of Accounting

|

| Chapter 10 | “Money and Banking” in Fundamentals of Business Copyright © 2022 by Florence Daddey and Rachael Newton is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. | Sources of Funding |

| Chapter 10 | “Accounting and Financial Information” in Introduction to Canadian Business, Accounting and Financial Information Copyright © 2024 by Business Faculty from Ontario Colleges and eCampusOntario Program Managers is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. | The Functions of Financial Statements |

| Chapter 10 | “Accounting and Financial Information” in Fundamentals of Business: Canadian Edition Copyright © 2018 (Canadian Edition) by Pamplin College of Business and Virgina Tech Libraries is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. | Financial Statement Analysis |

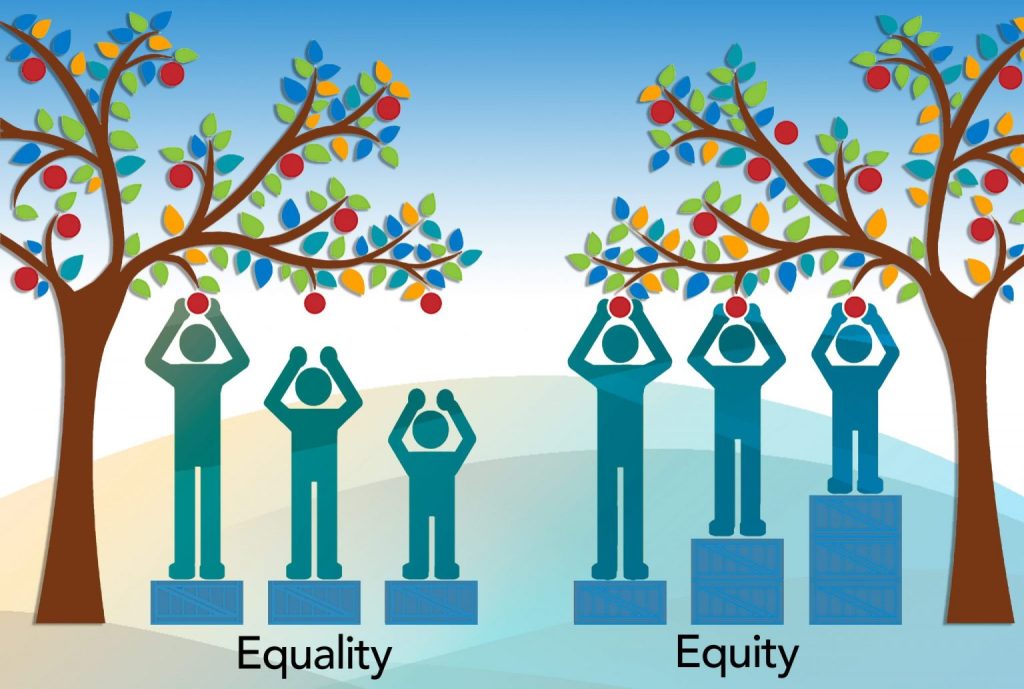

| Chapter 11 | Corporate Indigenous Inclusion” in Indigenous Lifeways in Canadian Business Copyright © 2022 by Russell Evans; Michael Mihalicz; and Maureen Sterling is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, except where otherwise noted. | Corporate Indigenous Inclusion: Equity, Diversity, and Inclusion (EDI) |

| Chapter 11 | “Managing Human Resources” in Managing Human Resources Copyright © 2024 by Business Faculty from Ontario Colleges and eCampusOntario Program Managers is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. | All (except Unions) with some adaptations |

| Chapter 12 | Risk Management – Supply Chain and Operations Perspective Copyright © 2024 by Azim Abbas and Larry Watson is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. | What is Risk? (partial with adaptations)

|

| Chapter 13 | “Personal Finances” in Introduction to Canadian Business, Personal Finances Copyright © 2024 by Business Faculty from Ontario Colleges and eCampusOntario Program Managers is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. | All with some adaptations |

(Note: This reference list was produced using the auto-footnote and media citation features of Pressbooks)

eCampus Ontario. (2021). About. https://www.ecampusontario.ca/about/#:~:text=eCampusOntario%20is%20a%20provincially-funded%20non-profit%20organization%20that%20leads,use%20of%20education%20technology%20and%20digital%20learning%20environments.

WAVE. (n.d.). WAVE accessibility evaluation tool. https://wave.webaim.org/

1

After reading this chapter, you should be able to do the following:

Why should you enroll in a college or university program? One of the most compelling reasons to attend college or university is to obtain credentials, learn skills and gain knowledge that will help you earn more money than you could without a postsecondary credential than you could over your lifetime. Some of the other benefits of obtaining a higher education credential include the following:

Lifelong learning is the ongoing, voluntary, and self-motivated pursuit of knowledge for either personal or professional reasons. Lifelong learning is a workplace necessity for most employees. It can help employees adapt to changing work demands, improve their performance, and increase their job satisfaction. Many organizations will provide professional development funds for employees’ personal learning and growth. Some companies may require employees to commit to a set number of months or years with the company after completing a company-funded professional development program.

In addition to the above benefits of obtaining a college or university credential, you will also build new skills that will help you obtain a job, retain the position, and be successful in growing your career. Specific jobs may require specific hard skills, such as a Web Designer who needs hard skills in using software in order to build websites. Beyond hard skills, soft skills are required in order for you to communicate, work in teams, and manage yourself professionally in the workplace. Soft skills are considered transferrable skills and are often considered employability skills. Employability skills are the skills you need to enter, stay in, and progress in the world of work—whether you work on your own or as part of a team. Some of the most important employability skills you will need is the ability to work well with others, be a productive team member, and communicate well with others. Did you know that 90% of projects require team participation as opposed to individual responsibility, and 31% of companies say that miscommunications about project objectives is the number one reason why projects fail?

The Conference Board of Canada provides The Employability Skills Toolkit for download. The Toolkit is a guide to the skills needed to adapt and succeed in the world of work. It includes explanations and descriptions of these skills and ways to build them. The Toolkit includes key information about how to become job-ready and exercises to practice and apply what you have learned. These activities encourage thinking about which skills you have, which skills you may need to work on, and how you can improve them. The updated version of the Toolkit also includes information on how to prepare for and succeed in the future of work. To help you understand some of the skills that are in high demand by employers, you’ll find new content on digital skills and social and emotional skills. Given the impacts of technology and automation on the working world, this version of the Toolkit also includes a new section on how to develop a change-ready, lifelong learning mindset, which is essential to help you navigate job transitions.

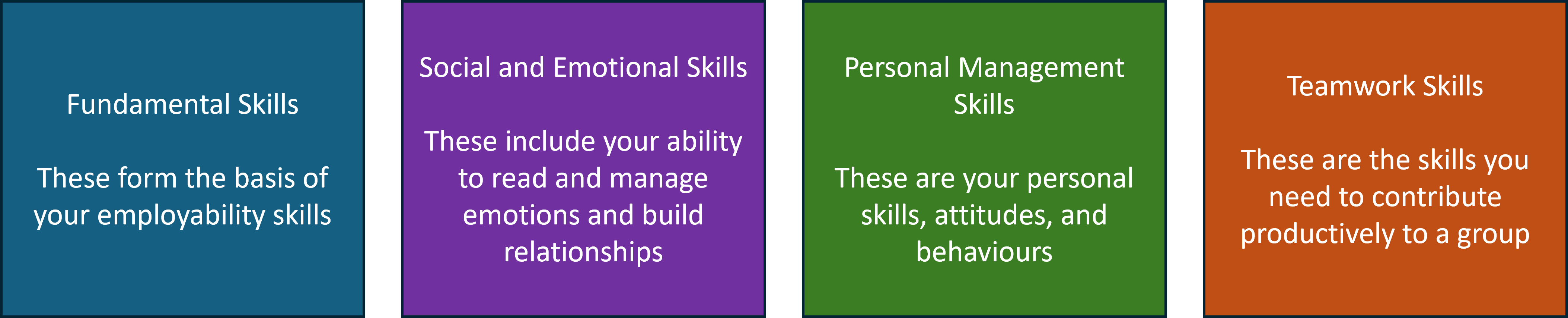

Employability skills fall into four broad categories as shown in Figure 1.1 below.

According to a blog post by Matt Gavin at Harvard Business School Online, every professional should know the following business fundamentals:

The communication skills identified by the Conference Board of Canada include the following.

In every job you will be required to work with people. In college and university, you often work with your peers on group projects. Interacting with colleagues, managers, customers, and suppliers is part of everyday communication.

The teamwork skills identified by the Conference Board of Canada, Work with Others, include the following:

The teamwork skills identified by the Conference Board of Canada, Participate in Projects and Tasks, include the following:

Play the YouTube video below, “Employability Skills – Have You Got them?” to learn about the soft skills you need to succeed in your academic career as well as your business career. Transcript for “Employability Skills – Have You Got Them?” Video [PDF–New Tab]. Closed captioning is available on YouTube.

College and university can be challenging when it comes to allocating time for studying and completing assignments.

Below is a list of 10 study tips that will help get you through those long study sessions.

A technique you might apply to reduce reading time is the SQ4R reading system. The SQ4R reading system is designed to help you study your textbook and apply reading and notetaking skills. The letters in SQ4R stand for five steps: survey, question, read, reflect, recite, and review. These steps will help you gain more from what you read and be better prepared for quizzes and exams. In other words, you will maximize the return on your time investment for reading!

It is important for you to identify your learning style. Which way do you learn best? Do you learn best by doing, by observing, by listening, by watching, or through a combination of these things. Learning styles refers to the different methods of learning or understanding new information, the way a person takes in, understands, expresses and remembers information. There are 4 predominant learning styles: Visual, Auditory, Read/Write, and Kinaesthetic. Often colleges and universities have assessments you can take that will help you identify your learning style as well as your strengths and abilities. The majority of people have one dominant learning style, although most people benefit from several different learning styles. When learning is presented in a way that is consistent with someone’s dominant learning style, they tend to learn more quickly and with less frustration.

When you are enrolled in a course, and you find you are struggling to learn the concepts, you may need to make a plan to help yourself. For example, if the professor is teaching in lecture format and you need more examples and videos then after class you might search online for videos or examples that will help you understand what the professor’s lecture was about. You might also ask questions and request additional exercises or a meeting with the professor, or maybe, you would do better by obtaining a tutor. You need to be proactive in your education and feel free to discuss issues that you may have with the professor, your academic advisor and your peers. You may be able to form a learning-buddy relationship with a peer which may help you both understand the lessons better.

Identify what support the institution provides for students and utilize what you need to be successful. Ask yourself these questions:

You will need to find answers to your many questions. Use the college or university website and read about student experience, student support, student services that the institution provides. When you are in need of support ask for it. You academic advisor, international advisor, professor, program coordinator, and service areas at the college or university can help. Everyone working at the college or university is there to support your learning journey and provide you with the tools and resources you need to be successful.

One of the most important things you need to understand in each course is the course outline (also referred to as course syllabus). You need to review this the first week of class and ask your professor questions if you do not understand how you will be graded. The course outline should provide you with a breakdown of what you can expect to be taught in the course, what the course learning outcomes (sometime called objectives) are, and how you will be assessed on your learning. Often assessment due dates are provided in advance, and you should record these in a calendar and always, always, work ahead of due dates. When you leave assignments until the night before they are due to complete them you are not preparing for success. So many things may go wrong, such as a technology failure or you may find you do not understand some of the instructions or you may find the assignment is much more time consuming than you had thought. You should always plan ahead and be prepared for things that may go wrong. Plan to have your assignments completed a day or two ahead of the due date, that way if your technology does fail, you will be able to use another device, or if you don’t understand some instructions then you have time to clarify these with the professor.

It is important to keep your grades as high as you can. You do this by planning your time well, keeping a calendar and working ahead of due dates, asking questions when you need help, and completing the learning tasks you are assigned. When students do the readings assigned, watch the videos assigned, and attend and participate in class, they often do very well in achieving high grades. Your GPA score (Grade Point Average) is a cumulation of the grades across the courses throughout your program. To graduate your institution will have a minimum GPA score you must achieve, and should you wish to further your education in the future your GPA score may factor into whether or not you will be accepted for enrollment at specific colleges or universities. If you decide in the future to study another program at a different institution you may want to apply for transfer credit and most colleges and universities have minimum grade requirements for accepting transfer credits (this is often a C grade, but check with the institution). Many schools calculate GPAs differently, but you can usually find this information on the institution’s website.

Academic integrity is a commitment to acting with honesty, trust, fairness, respect, and responsibility in academic work and studies. A few questions to ask yourself when completing school assignments include the following.

The answer to each of these questions is generally, NO!

With that said, there may be occasions when your professor allows you to use generative AI to help you research or get started with a writing assignment. When you do use ChatGPT or other AI tools you will need to cite it as a source of information in the same way you would cite a website, video, book, or other source of information you may use. Remember that you may only use the resources permitted by the professor to aid you in completing assignments, otherwise, your work may be identified as plagiarized or in breach of the academic integrity policy. Be sure you familiarize yourself with the institution’s policies, and specifically the academic integrity policy.

Formatting standards for documentation are common in higher education as well as in the workplace. Most companies have documentation standards that apply to all correspondence that leaves the company, such as business letters, reports, flyers, brochures, marketing media, website media, and social media. Businesses work hard to portray a certain image to the public and they want that image to be consistent across all their communication channels. A citation style dictates the information necessary for a citation and how the information is ordered, as well as punctuation and other formatting. Popular citation styles such as APA and MLA provide guidelines to authors in how to format documents for professionalism, for crediting other people’s words and ideas via citations and references to avoid plagiarism, and for describing other people using inclusive, bias-free language.

Most college and university libraries provide style guides for APA, MLA and other document formats. The Online Writing Lab (OWL) Purdue Citation Chart provides examples of various citations for both in-text and reference list citations. Additional details are available at the OWL Purdue website. Review OWL Purdue APA Formatting Guidelines and the library guides from CSUDH are also very comprehensive.

Play the YouTube video below, “Introduction to Citation Styles: APA 7th ed.” to learn about the purpose and basic conventions of citing sources in-text and in a reference list using the American Psychological Association (APA) Style, 7th edition, 2019. Transcript for “Introduction to Citation Styles: APA 7th ed.” Video [PDF–New Tab]. Closed captioning is available on YouTube.

The book entitled “The 7 Habits of Highly Effective People” written by Stephen R. Covey is based on Covey’s belief that the way we see the world is entirely based on our own perceptions. In order to change a given situation, we much change ourselves, and in order to change ourselves, we must be able to change our perceptions.

Spend a little time researching the following seven habits to really understand what they mean:

Career success can be highly subjective, meaning each person gets to define what success looks like for them. For some people, a successful career is one that provides the most enjoyment. For others, a successful career is one that provides certain financial benefits. Regardless of how you define it, achieving your goal of a successful career can be an exciting and empowering experience.

Time management is an essential life skill and one that will make a huge difference in your career. Time management is the practice of planning and controlling how you use your time to be more productive and efficient. It involves prioritizing tasks, setting deadlines, and avoiding distractions. The goal of time management is to complete important tasks on time while also balancing your personal, professional, and academic responsibilities. Some benefits of effective time management include less stress, more time for creative or strategic projects, better work quality, and more self-confidence. Managing time is an essential part of every busy business professional’s job. Most professionals use an electronic calendar to track appointments, meetings, events, etc.

Play the YouTube video below, “Time Management Techniques for Stress Free Productivity” YouTube video below for some time management tips for stress-free productivity. Transcript for “Time Management Techniques for Stress Free Productivity” Video [PDF–New Tab]. Closed captioning is available on YouTube.

Stress is a part of everyone’s life. Stress is a physical, mental, and emotional response to a difficult event. Stress Management offers a range of ways to help you better deal with stress and difficulty in your life. Engaging in activities that support self-care may help reduce stress and anxiety. These can include exercise and mindfulness practices.

Listed below are 16 evidence-based ways to relieve stress:

Get more physical activity

Often students become stressed when there is a test to take. Your institution may provide some test-taking tips. Below are a few test-taking tips from various colleges and universities.

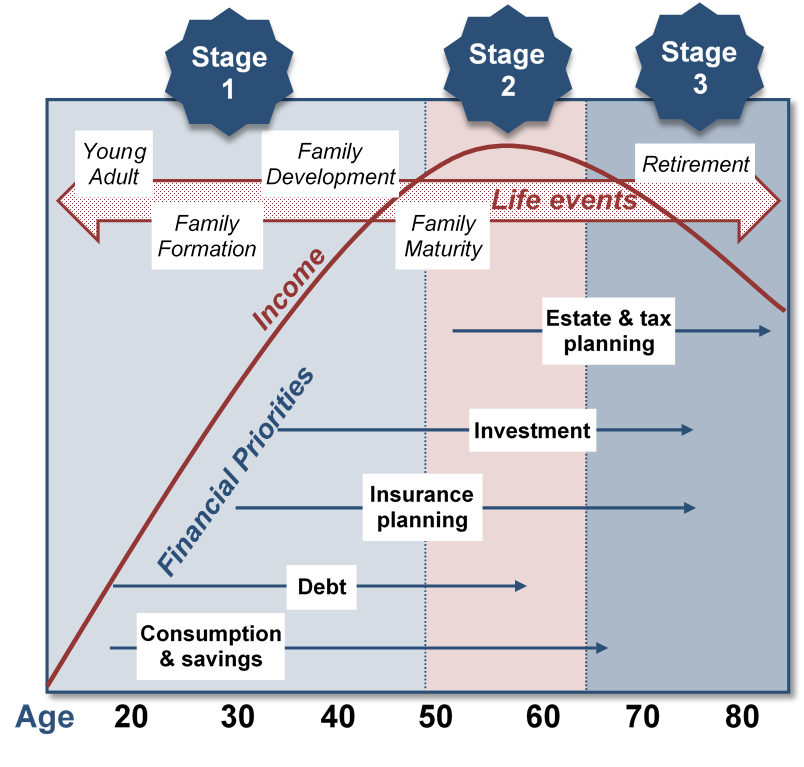

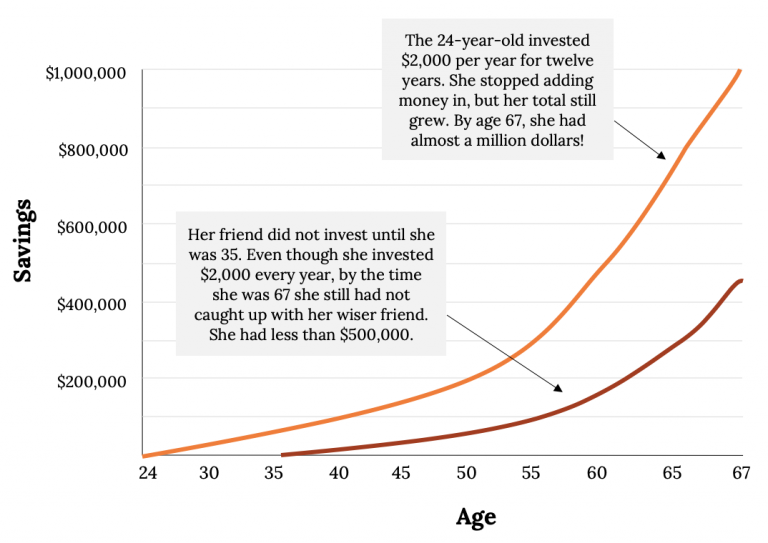

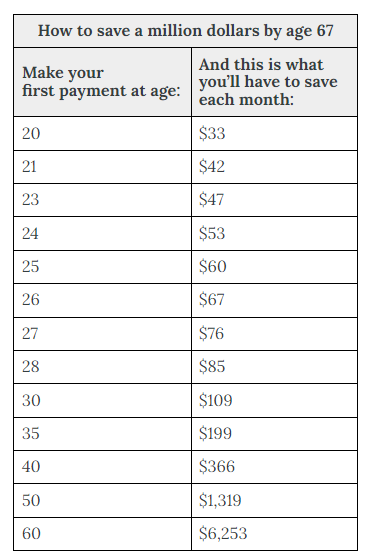

The chapter, “Managing Personal Finances”, goes into more detail on this subject, for now let’s get introduced to the concepts.

Students become stressed when they need to pay bills and don’t have enough funds to do so. Colleges and universities understand that students have complex lives and often need to work part-time jobs in order to pay their bills. With that said, as a full-time student, these institutions expect you to prioritize your studies since you have paid tuition fees to enroll. No student wants to fail a course and have to pay to re-take it, but if you do not focus on your studies this may happen. Planning your time effectively is a good way to ensure you are spending enough time on your studies.

Entering college is an exciting and sometimes intimidating venture for many young adults—often it’s the first time many leave the warmth and safety of their parent’s home and have to live and manage on their own. One specific area that causes young adults difficulty is learning to budget.

A budget is a financial plan that estimates how much money you’ll make and spend over a specific period of time. It can be used by individuals, families, businesses, and governments. The chapter, “Managing Personal Finances” goes into more detail on this subject, for now let’s get introduced to the concepts.

Below are a few suggestions on how college students can more effectively manage their money while furthering their education:

Creating and using a budget is not just for those who need to closely monitor their cash flows from month to month because money is tight. Almost everyone can benefit from budgeting. Building the right college student budget for your situation can help you stay on track for your financial life after graduation. Plus, learning to build and maintain a budget is an important skill to carry with you for the rest of your life. If you aren’t sure how to create the perfect college budget that works for you, then check out this free budgeting course. It will walk you through the steps of building a budget that actually sticks.

Play the YouTube video below, “Time Management Techniques for Stress Free Productivity” YouTube video below for some time management tips for stress-free productivity. Transcript for “How To: The Easiest and Simplest Way to Create a Monthly Budget! 6-Minute Process” Video [PDF–New Tab]. Closed captioning is available on YouTube.

College and university students often wonder how they will gain business work experience. Many work part-time jobs while attending school, but these jobs are usually entry-level service jobs paying minimum wage. Some students have no work experience or have never worked in Canada. Most students hope to work in the field they are studying after they graduate. So how can you gain business experience in your field of study that will help you obtain a job after you graduate?

Review the list below for some ideas on how to gain work experience:

The Careers and Co-op office within your institution may provide support and resources that will help you find part-time work while you are studying and/or a co-op placement (if this is an option within your program).

Business etiquette is a type of social and business behaviour that team members (whether at school or work) are expected to exhibit. It includes how people communicate, dress, and conduct themselves in meetings and social events. Adhering to business etiquette can help foster positive relationships and a harmonious work environment. Some examples of business etiquette include treating others with courtesy and consideration, controlling your emotions and actions, being accountable for your actions and obligations, and meeting deadlines and admitting mistakes.

So, what are some pet peeves you have? Pet peeves are the thing that annoy you, often things other people do that bother you. Check out this list of 87 Common Things That Annoy People. A good guideline is to try not to be the one who is annoying others, especially when working on a team or taking a potential customer out for lunch. Here are a few annoyances college students have shared with their professor over the years:

There are many things that annoy us all, but we need to remember that other people may have grown up with cultural norms that differ from your own. Cultural norms are the standards we live by. They are the shared expectations and rules that guide behavior of people within social groups. Cultural norms are learned and reinforced from parents, friends, teachers and others while growing up in a society. Norms often differ across cultures, contributing to cross-cultural misunderstandings. For example, it may be customary in certain parts of China and India to belch after a meal, but in Canada and the U.S. this would be considered rude. Punctuality around the world varies: Being on time is important in Canada and U.S. business settings, but being on time is not a concern in Greece, Brazil, or Mexico. In some cultures, they do not sit on toilet seats, so you may have noticed shoe prints on toilet seats or spillage, or unflushed toilets. This is a bathroom etiquette issue; in Canada toilet seats are expected to be clean and dry. The main thing with etiquette is respect the cultural norms of other people, and exercise professionalism, and practice business etiquette at the location you are in. You will learn more about cultural norms and inter-cultural communication when you complete a course in organizational behaviour or business communications.

Professionalism is a broad concept that includes a person’s attitude, work ethic, and conduct. It also involves being punctual, dressing appropriately, and having a positive attitude. Business etiquette is a key component of professionalism. Some of the traits of professionalism include being dependable and accountable, demonstrating a sense of etiquette, making ethical decisions, being a team player, and maintaining a positive outlook.

Watch “The Five Zones of Professional Etiquette” YouTube video below to learn about professional etiquette. Transcript for “The Five Zones of Professional Etiquette (Student Version)” Video [PDF–New Tab]. Closed captioning is available on YouTube.

To complete this exercise, you may need to do a little research on The 7 Habits of Highly Effective People:

An interactive H5P element has been excluded from this version of the text. You can view it online here:

https://ecampusontario.pressbooks.pub/businessfundamentals/?p=5#h5p-1

(Note: This reference list was produced using the auto-footnote and media citation features of Pressbooks)

Rego, A. (2021, February 23). Prepare for Canada. Higher education offers benefits to newcomers. https://www.prepareforcanada.com/before-you-arrive/settling-in-canada/higher-education-offers-benefits-to-newcomers/#:~:text=Three%20Benefits%20of%20Higher%20Education%20in%20Canada%201,in%20Canada.%20…%203%203.%20Network%20with%20Others

World Education Services. About WES credential evaluation. https://knowledge.wes.org/WES_Credential_Evaluations.html

Andrews, G. (2024, August 12). Is college worth it? Consider these factors before enrolling. Forbes. https://www.forbes.com/advisor/education/student-resources/is-a-college-degree-worth-it/

Statistics Canada. (2023, October 4). Employment income statistics by highest level of education: Canada, provinces and territories, census divisions and census subdivisions. https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=9810041101

Kumok, Z. (2023, June 14). 7 compelling reasons why you should go to college. Forbes. https://www.forbes.com/advisor/student-loans/why-should-you-go-to-college/

Kumok, Z. (2023, June 14). 7 compelling reasons why you should go to college. Forbes. https://www.forbes.com/advisor/student-loans/why-should-you-go-to-college/

Kumok, Z. (2023, June 14). 7 compelling reasons why you should go to college. Forbes. https://www.forbes.com/advisor/student-loans/why-should-you-go-to-college/

Stone, K. (2020, July 9). The state of project management in 2023 [42 statistics]. https://saaslist.com/blog/project-management-statistics/#:~:text=90%25%20of%20projects%20require%20team,participation%20as%20opposed%20to%20individual%20responsibility

Conference Board of Canada. (2023). Finding your employability skills. https://www.conferenceboard.ca/future-skills-centre/tools/finding-your-employability-skills/

Gavin, M. (2019, September 26). 7 business fundamentals professionals in every industry should know. https://online.hbs.edu/blog/post/business-fundamentals

The Conference Board of Canada. (2022). Finding your employability skills. https://www.conferenceboard.ca/future-skills-centre/tools/finding-your-employability-skills/

The Conference Board of Canada. (2022). Finding your employability skills. https://www.conferenceboard.ca/future-skills-centre/tools/finding-your-employability-skills/

The WOW Show. (2020). Employability skills – have you got them? [Video]. YouTube. https://www.youtube.com/watch?v=tKKPUYfOkvw

Claire. (2024, August 1). 12 insanely smart study hacks for college students. Collegesavvy. https://mycollegesavvy.com/study-hacks-for-college-students/

Utah State University. (n.d.). SQ4R reading system. [PDF]. https://www.usu.edu/academic-support/files/SQ4R_Reading_System.pdf

CSUDH Library. (2019, October 29). Introduction to citation styles: APA 7th ed. [Video]. YouTube. https://www.youtube.com/watch?v=_fVv2Jt0o18&t=2s

Nicholson, R. (2024, July 16). 7 habits of highly effective people. Hubspot. https://blog.hubspot.com/sales/habits-of-highly-effective-people-summary#7-habits-of-highly-effective-people

Herrity, J. (2024, August 15). 9 tips for building a successful career you enjoy. https://www.indeed.com/career-advice/career-development/building-career

Brower, T. (2024, October 31). How 5 mindfulness techniques can help your workplace productivity. https://www.forbes.com/sites/tracybrower/2024/10/28/how-5-mindfulness-techniques-can-help-your-workplace-productivity/

Greiser, C. (2018, April 26). Unleashing the power of mindfulness in corporations. https://www.bcg.com/publications/2018/unleashing-power-of-mindfulness-in-corporations

Mind Tools, (n.d.). Mindfulness in the workplace. https://www.mindtools.com/adzev6y/mindfulness-in-the-workplace

Brower, T. (2024, October 31). How 5 mindfulness techniques can help your workplace productivity. https://www.forbes.com/sites/tracybrower/2024/10/28/how-5-mindfulness-techniques-can-help-your-workplace-productivity/

Young Entrepreneurs Forum. (2016, August 15). Time management techniques for stress free productivity. [Video]. YouTube. https://youtu.be/IGVQPU-L7cQ

Kubala, J. (2023, July 12). 16 simple ways to relieve stress. https://www.healthline.com/nutrition/16-ways-relieve-stress-anxiety#3-Minimize-phone-use-and-screen-time

Segal, T. (2024, October 26). Money management for college students. https://www.investopedia.com/financial-edge/0712/money-management-for-college-students.aspx#:~:text=Key%20Takeaways%201%20College%20students%20need%20to%20set,purchases%20is%20also%20a%20key%20money%20management%20tactic.

Ganti, A. (2024, October 17). What is a budget? Plus 11 budgeting myths holding you back. https://www.investopedia.com/terms/b/budget.asp

Sharkey, S. (2024, September 27). How to create a college student budget you’ll actually use. https://www.clevergirlfinance.com/college-student-budget/

Budgets, S. (2019, July 19). How to: The easiest and simplest way to create a monthly budget! 6-Minute process. [Video]. YouTube. https://www.youtube.com/watch?v=3pslPbfpnzk

Bovee and Thill. (Young Entrepreneurs Forum. (2018, January 20). The five zones of professional etiquette (student version). [Video]. YouTube. https://www.youtube.com/watch?v=A9Q20hZ5ZX4

2

After reading this chapter, you should be able to do the following:

North American business history is divided into the following several distinct time periods:

Canada’s system of government is based on the British parliamentary model and is quite distinct from the presidential system operating in the United States. Canada’s legislative and executive jurisdiction is constitutionally divided between the federal government and the ten provincial governments. A business may be regulated at three levels: federal, provincial, and municipal. A business may also be affected by the policies and decisions of regulatory and administrative bodies and tribunals.

Government influences business activity through the roles it plays. Some of these include the following:

Take a moment to think about the many different types of businesses you come into contact with on a typical day. As you drive to class, you may stop at a gas station that is part of a major national oil company and grab lunch from a fast food chain such as Taco Bell, McDonald’s, or the neighbourhood pizza place. Need more cash? You can do your banking on a smartphone or another device via mobile apps. You don’t even have to visit the store anymore: online shopping brings the stores to you, offering everything from clothes to food, furniture, and concert tickets.

A business is an organization that strives for a profit by providing goods and services desired by its customers. Businesses meet the needs of consumers by providing medical care, automobiles, and countless other goods and services. Goods are tangible items manufactured by businesses, such as laptops. Services are intangible offerings of businesses that can’t be held, touched, or stored. Physicians, lawyers, hairstylists, car washes, and airlines all provide services. Businesses also serve other organizations, such as hospitals, retailers, and governments, by providing machinery, goods for resale, computers, and thousands of other items.

Revenue is the money a company receives by providing services or selling goods to customers. Costs are expenses including rent, salaries, supplies, transportation, and many other expenses a company incurs from creating and selling goods and services. For example, some of the costs Microsoft incurred by developing its software include salaries, facilities, and advertising. If Microsoft has money left over after it pays all costs, it has a profit. A company with costs greater than revenues incurs a loss. When a company such as Microsoft uses its resources intelligently, it can often increase sales, hold costs down, and earn a profit. Not all companies earn profits, but that is the risk of being in business. Risk is the potential to lose time and money or otherwise not be able to accomplish an organization’s goals. For example, the Canadian Red Cross faces the risk of not meeting the demand for victims of disaster (patients who need blood) if there are not enough blood donors. Businesses such as Microsoft face the risk of falling short of their revenue and profit goals. In Canadian business today, there is generally a direct relationship between risks and profit: the greater the risks, the greater the potential for profit (or loss).

The owner or shareholders of a business are not the only people who benefit from the business’s earned profits. A successful business provides employment opportunities, goods and services people need and want, tax payments to the government, and spends money buying resources which stimulates the economy. Socially responsible firms contribute even more by adopting policies that promote the well-being of society and the environment while lessening the negative impacts on them.

Not every organization that generates revenue and pays expenses is considered a for-profit business. Not all organizations strive to make a profit. A not-for-profit organization is an organization that exists to achieve some goal other than the usual business goal of profit at all costs. Often these organizations serve communities through social, educational, or political means. Organizations such as universities and colleges, hospitals, environmental groups, and charities are not-for-profit organizations. Charities such as Habitat for Humanity, the United Way, the Canadian Cancer Society, and the World Wildlife Fund are not-for-profit organizations, as are most hospitals, zoos, arts organizations, civic groups, and religious organizations. Over the last 20 years, the number of not-for-profit organizations—and the employees and volunteers who work for them—has increased considerably. Government is our largest and most pervasive not-for-profit group.

Like their for-profit counterparts, these groups set goals and require resources to meet those goals. However, their goals are not focused solely on profits. For example, a not-for-profit organization’s goal might be feeding the poor, preserving the environment, increasing attendance at the ballet, or preventing drunk driving. Not-for-profit organizations do not compete directly with one another in the same manner as, for example, Ford and Honda, but they do compete for talented employees, people’s limited volunteer time, and donations.

The boundaries that formerly separated not-for-profit and for-profit organizations have blurred, leading to a greater exchange of ideas between the sectors as for-profit businesses are now addressing social issues. Successful not-for-profits apply business principles to operate more effectively. Not-for-profit managers are concerned with the same concepts as their colleagues in for-profit companies: developing strategy, budgeting carefully, measuring performance, encouraging innovation, improving productivity, demonstrating accountability, and fostering an ethical workplace environment.

In addition to pursuing a museum’s artistic goals, for example, top executives manage the administrative and business side of the organization: human resources, finance, and legal concerns. Ticket revenues cover a fraction of the museum’s operating costs, so the director spends a great deal of time seeking major donations and memberships. Today’s museum boards of directors include both art patrons and business executives who want to see sound fiscal decision-making in a not-for-profit setting. Therefore, a museum director must walk a fine line between the institution’s artistic mission and financial policies.

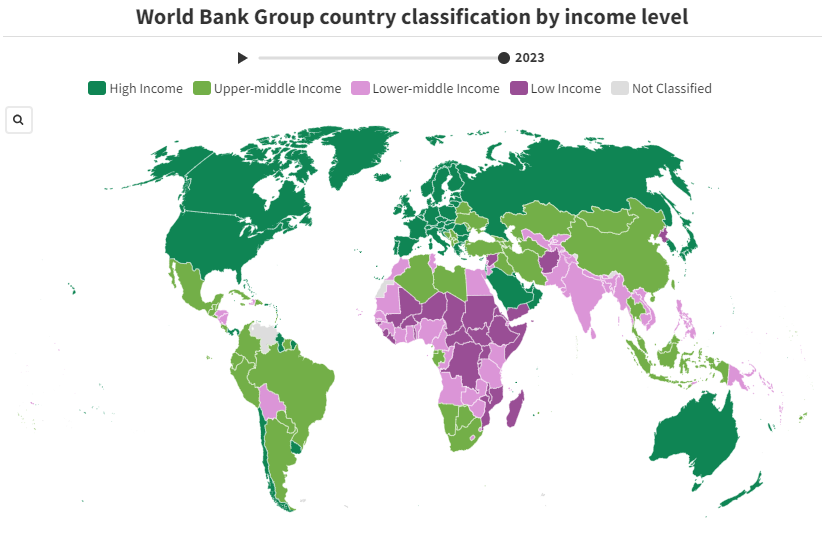

Successful businesses help to raise a country’s standard of living because they create the goods and services that are the basis of our standard of living. The standard of living of any country is measured by the output of goods and services people can buy with the money they have. It’s the ease with which people living in a time or place are able to satisfy their needs and wants. It is generally measured by standards such as income per person and poverty rate. Other measures are also used, such as access to and quality of health care, income-growth inequity, availability of employment, environmental quality, and educational standards. One measure of the standard of living is the Human Development Index (HDI), which was developed by the United Nations. Canada was ranked #18 out of 193 countries and territories worldwide on the 2023/2024 HDI report (Refer to Table 2.1).

| Country | Rank |

|---|---|

| Canada | 18 |

| United States | 20 |

| Germany | 7 |

| United Kingdom | 15 |

| Switzerland | 1 |

| Norway | 2 |

| Hong Kong | 4 |

| China | 75 |

| Finland | 12 |

| India | 134 |

| Somalia | 193 |

| Pakistan | 164 |

| Yemen | 186 |

Businesses play a key role in determining our quality of life by providing jobs, goods, and services to society. Quality of life refers to the general level of human happiness based on factors including life expectancy, educational standards, health, sanitation, and leisure time. It takes into account not only the material standard of living, but also more intangible aspects that make up human life. Building a high quality of life is a combined effort between businesses, government, and not-for-profit organizations. In a Mercer Insights report for 2023, Vienna, Austria, ranked highest in quality of life, followed by Zurich, Switzerland; Auckland, New Zealand; and Copenhagen, Denmark. It may come as a surprise that not one of the world’s top cities is in the United States: seven of the top 10 locations are in western Europe, two are in Australia/New Zealand, and one is in Canada (#8 on the list). At the other end of the scale, Baghdad, Iraq, is the city scoring the lowest on the annual survey.

Businesses must observe trends in business as many trends stem from consumer demands and preferences. Companies must keep up with their competitors, observe changes in the business environment, and meet consumer demands if they wish to stay in business.

Some of the current business and consumer trends include the following:

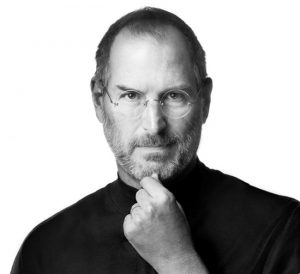

Why is Apple so successful?

In 1976 Steve Jobs and Steve Wozniak created their first computer, the Apple I. They invested a mere $1,300 and set up business in Jobs’ garage. Three decades later, their business—Apple Inc.—has become one of the world’s most influential and successful companies. Jobs and Wozniak were successful entrepreneurs: those who take the risks and reap the rewards associated with starting a new business enterprise.

Did you ever wonder why Apple flourished while so many other young companies failed? How did it grow from a garage start-up to a company generating over $394 billion in sales in 2022? How was it able to transform itself from a nearly bankrupt firm to a multinational corporation with locations all around the world? You might conclude that it was the company’s products, such as the Apple I and II, the Macintosh, or more recently its wildly popular iPod, iPhone, and iPad. Alternatively, you could decide that it was its dedicated employees, management’s wiliness to take calculated risks, or just plain luck – that Apple simply was in the right place at the right time.

Before you draw any conclusions about what made Apple what it is today and what will propel it into a successful future, you might like to learn more about Steve Jobs, the company’s co-founder and former CEO. Jobs was instrumental in the original design of the Apple I and, after being ousted from his position with the company, returned to save the firm from destruction and lead it onto its current path. Growing up, Jobs had an interest in computers. He attended lectures at Hewlett-Packard after school and worked for the company during the summer months. He took a job at Atari after graduating from high school and saved his money to make a pilgrimage to India in search of spiritual enlightenment. Following his India trip, he attended Steve Wozniak’s “Homebrew Computer Club” meetings, where the idea for building a personal computer surfaced.

“Many colleagues describe Jobs as a brilliant man who could be a great motivator and positively charming. At the same time his drive for perfection was so strong that employees who did not meet his demands [were] faced with blistering verbal attacks.” Not everyone at Apple appreciated Jobs’ brilliance and ability to motivate. Nor did they all go along with his willingness to do whatever it took to produce an innovative, attractive, high-quality product. So, at age thirty, Jobs found himself ousted from Apple by John Sculley, whom Jobs himself had hired as president of the company several years earlier. It seems that Sculley wanted to cut costs and thought it would be easier to do so without Jobs around. Jobs sold $20 million of his stock and went on a two-month vacation to figure out what he would do for the rest of his life. His solution: start a new personal computer company called NextStep. In 1993, he was invited back to Apple (a good thing, because neither his new company nor Apple was doing well).

Steve Jobs was definitely not known for humility, but he was a visionary and had a right to be proud of his accomplishments. Some have commented that “Apple’s most successful days occurred with Steve Jobs at the helm.”

Jobs did what many successful CEOs and managers do: he learned, adjusted, and improvised. Perhaps the most important statement that can be made about him is this: he never gave up on the company that once turned its back on him. So now you have the facts. What do you think Apple’s success is due to? (a) its products, (b) its customers, (c) luck, (d) its willingness to take risks, (e) Steve Jobs, or (f) some combination of these options. What impact has Apple had on technological advances with its over 500 devices?

Businesses are often categorized into specific groupings called sectors, which can be based on business activities, how profits are managed, or the industry in which the business operates.

The public business sector includes goods and services produced, delivered, and allocated by the government and public sector organizations (publicly controlled government business enterprises). The government sector includes all federal, provincial, municipal, and territorial government ministries and departments. It also includes public school boards, public universities and colleges, and public health and social service institutions. Public sector organizations operate in the marketplace, often in competition with privately owned organizations. Government may have direct or indirect control over public sector organizations, which are also referred to as Crown corporations. The aim of the public sector is to provide services that benefit the public as a whole, either because it would be difficult to charge people for the goods and services concerned or because people may not be able to afford them. The government can provide these goods and services at a lower price than if they were provided by a for-profit company. Examples include public utilities, such as water and sewage, electricity, and gas, as well as nationalized industries such as coal and steel.

The private business sector includes goods and services produced and delivered by private individuals or groups as a means of enterprise for profit. The sector is not controlled by government. These businesses can be small firms owned by just one person, or large multinational businesses that operate globally. Large businesses may have many owners. A public (or publicly traded) company within the private business sector is not part of the public sector (government-provided services and government owned organizations); it is a particular kind of private sector company that can offer its shares for sale to the general public (i.e., Microsoft, Apple, Proctor & Gamble).

The non-profit or voluntary sector includes non-governmental, non-profit organizations that receive support from individual citizens, government, and businesses. Non-profit organizations (NPOs) are also referred to as private voluntary organizations (PVOs); not-for-profit organizations (NFPOs); or non-profit making, non-governmental organizations (NGOs). In the global business world, there is inconsistency in how these terms are defined. A non-profit organization could be a not-for-profit corporation or an unincorporated association. A not-for-profit corporation is usually created with a specific purpose in mind and could be a foundation or charity or other type of non-profit organization. A private voluntary association is a group of volunteers who enter an agreement to form an organized body to accomplish a purpose. For the purposes of this book, not-for-profit corporations, private voluntary organizations, and non-governmental organizations are classified in the non-profit and voluntary sector as non-profit organizations.

Non-profit organizations have the ability to respond to issues more quickly than government and are usually formed or expanded in reaction to a community need that is not being met by the government. The Canadian government recognizes the importance of the non-profit sector as a key partner in building a stronger Canada, and it supports the sector in a number of ways, such as partnering, streamlining funding practices and accountability, and developing knowledge on the non-profit sector.

Non-profit organizations operate in a variety of areas including sports, religion, arts, culture, fundraising, and housing. Various organizations include hospitals, universities and colleges, research organizations, business and professional associations, and unions. Non-profit organizations experience problems with planning for the future, recruiting the types of volunteers needed, and obtaining board members and funding. People who work in non-profit organizations may be paid employees or unpaid volunteers.

There can be confusion around which sector a business is in. Is a hospital in the public or private sector? Are all hospitals non-profit organizations? Is the private sector university a non-profit or a for-profit organization? This confusion exists because some types of organizations typically thought of as belonging to the non-profit sector can cross sectors. For example, in Ontario there are four types of hospitals, including public, private, federal and Cancer Care Ontario hospitals. Public sector hospitals are owned by the government and receive government funding. Private sector hospitals are privately owned, often by a for-profit company or a non-profit organization, and are funded through patient payments, insurers, grants, donations, and foreign embassies. Private hospitals and health care clinics are classified as being in either the private, for-profit or private, non-profit sectors and are quite common in the United States and Australia. Canada’s mix of public and private health care options leaves many people thinking that the hospitals in Canada belong to the public sector because hospital services are publicly delivered, funded, and governed, and hospitals are accountable to the public. In fact, hospital services in many provinces are delivered largely by private sector, non-profit organizations.

Similarly, Canada has private sector, for-profit and private sector, non-profit colleges and universities in addition to its many public, non-profit colleges and universities. Private colleges and universities are not operated by the government, although many have received public subsidies, and depending on the province they reside in, they may be subject to government regulations. Some of the world’s most renowned universities, such as Harvard University, Stanford University, and Massachusetts Institute of Technology (MIT), are private sector, non-profit universities.

Across the three sectors, businesses may be classified by industry, such as service-producing industries and goods-producing industries, using the North American Industry Classification System (NAICS).

Business participants are the people who participate in conducting the work of the business. These always include the employees and managers, but often include suppliers, customers, and shareholders. Every business must have one or more owners whose primary role is to invest money in the business. When a business is being started, it is generally the owners who polish the business idea and bring together the resources (money and people) needed to turn the idea into a business. The owners also hire employees to work for the company and help it reach its goals. Owners and employees depend on a third group of participants— customers. Ultimately, the goal of any business is to satisfy the needs of its customers in order to generate a profit for the owners. Other participants can include suppliers and even competitors.

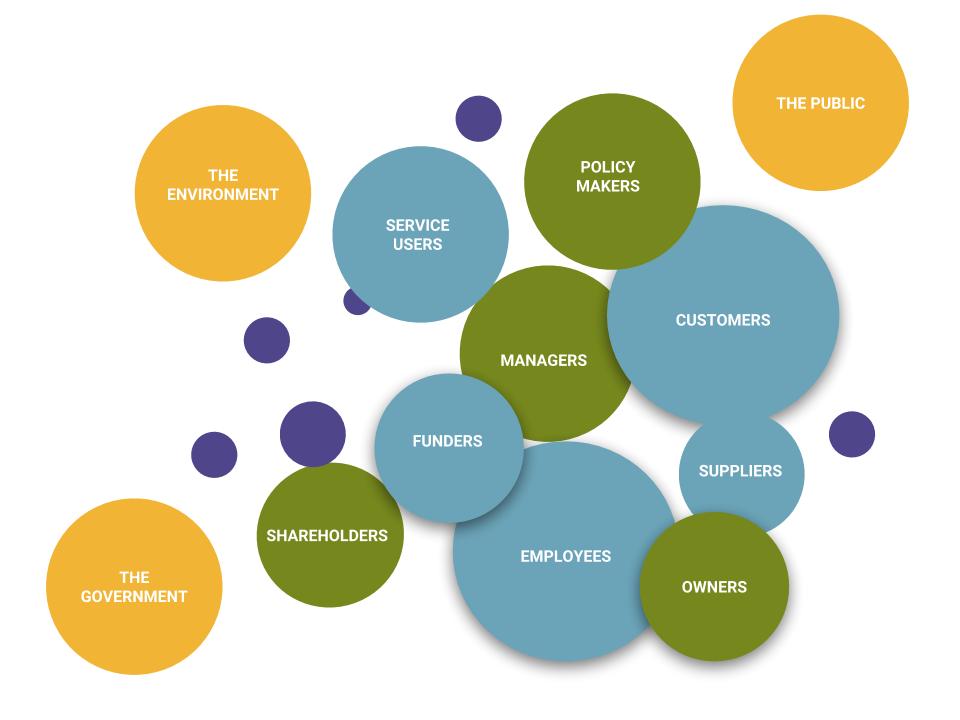

Stakeholders are those affected by the business’s operations and its decisions. Examples of stakeholders include shareholders, investors, suppliers, the community, customers, employees, competitors, and governmental agencies. Consider your favorite restaurant. It may be an outlet or franchise of a national chain (more on franchises in a later chapter) or a local “mom and pop shop” without affiliation to a larger entity. Whether national or local, every business has stakeholders – those with a legitimate interest in the success or failure of the business and the policies it adopts. Stakeholders include customers, vendors, employees, suppliers, landlords, competitors, bankers, and others (see Figure 2.1). Other stakeholders include the general public, the environment and all the various government departments that impact the business. All have a keen interest in how the business operates, in most cases for obvious reasons. If the business fails, employees will need new jobs, vendors will need new customers, and banks may have to write off loans they made to the business. Stakeholders do not always see things the same way — their interests sometimes conflict with each other. For example, lenders are more likely to appreciate high profit margins that ensure the loans they made will be repaid, while customers would probably appreciate the lowest possible prices. Pleasing stakeholders can be a real balancing act for any company.

Functional areas in a business refer to different departments or sections that perform specific tasks, such as human resources, operations, accounting, and finance. Each functional area has a unique role in achieving the overall business objectives, and they need to work in cooperation to ensure that the company operates smoothly and effectively. Depending on who you ask, you may receive different answers about how many functional areas there are in a business. It really depends on how the business is structured (more on this later). Some people will say there are four functional areas, some say five, some say six or even seven. Examples of functional areas include human resources, operations, marketing, accounting, finance, information technology, strategy, leadership, team, marketing and sales, production and operations, research and development, employment and human resources, insurance and risk management, and so on .

Let us briefly explore each of the six functional areas listed below (Shown in Figure 2.2). When we look at the functional area of business, we are organizing the work in terms of the type of work. In small businesses, the owner may do the finance, accounting, and human resource functions along with overseeing the operations. In large businesses, these functions are often broken down into departments that have large groups of people working within each function.

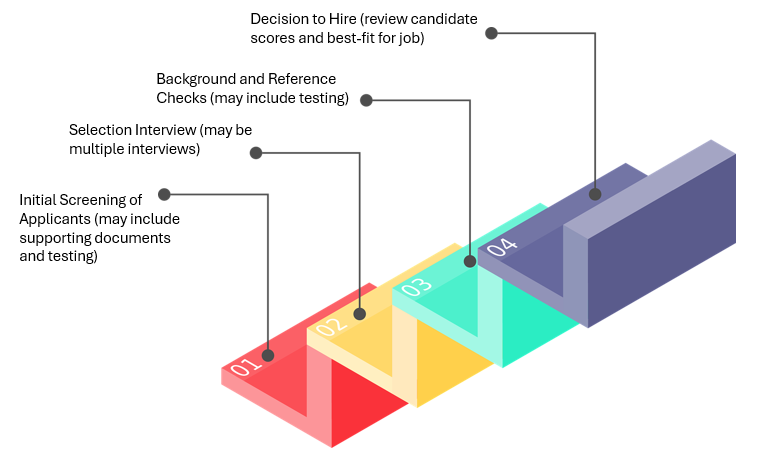

The Human Resources (HR) functional area is an organizational function that is about searching for, selecting, training, and maintaining workers. HR managers are responsible for ensuring that the organization has all of the skills and capabilities necessary to run the business. HR managers develop staffing plans, recruit and select new employees, monitor the performance management process, and develop succession plans for advancement and replacement. They develop standards for compensation and benefits and assist managers with staff issues.

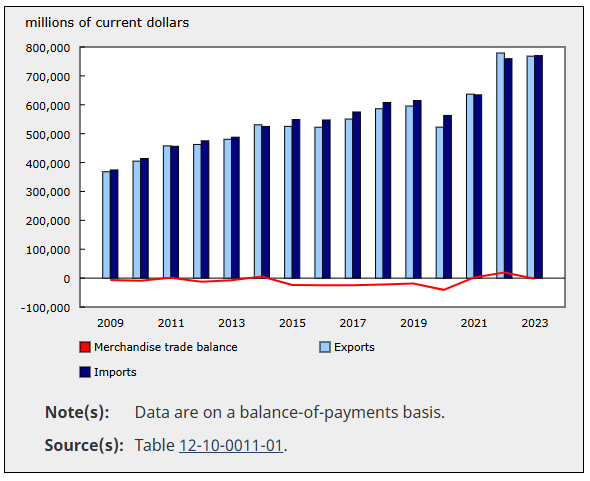

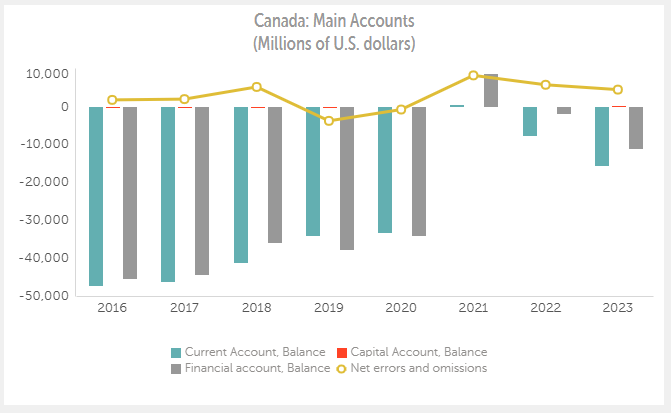

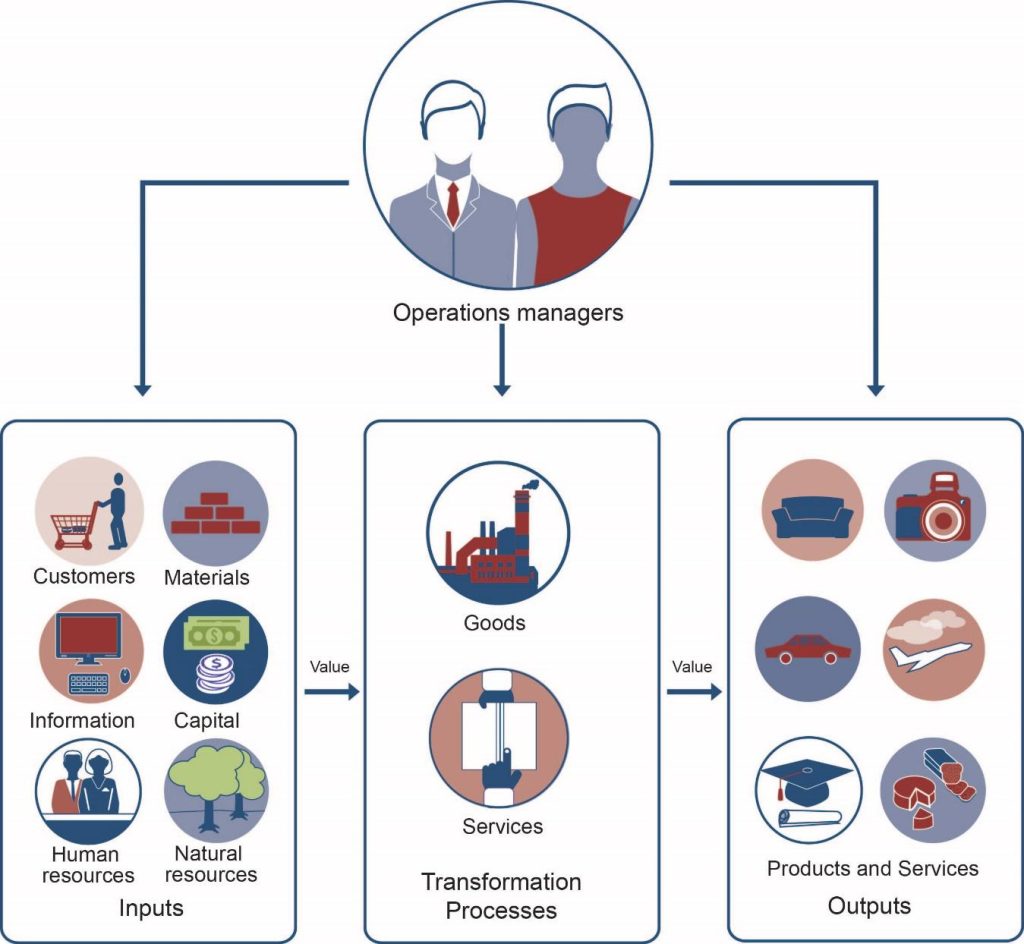

Operations is the organizational function that is focused on producing the goods and/or services of the business. Operations involve managing the processes and resources that create goods and services in a business. It is responsible for ensuring efficiency, quality, and cost-effectiveness in production, distribution, and delivery to meet customer demand and achieve organizational objectives. All companies must convert resources (labour, materials, money, information, and so forth) into goods or services. Some companies, such as Apple, convert resources into tangible products — iPads, iPhones, etc. Others, such as hospitals, convert resources into intangible products, e.g., health care. The person who designs and oversees the transformation of resources into goods or services is called an operations manager. This individual is also responsible for ensuring that products are of high quality. In many organizations, operations management includes managing the supply chain which controls the delivery of raw materials and the distribution of finished goods.

Marketing plays a crucial role in a business by helping to identify, create, and satisfy customer needs and wants through the promotion of products or services. Effective marketing strategies can help businesses differentiate themselves from competitors, build brand awareness and loyalty, increase sales and revenue, and ultimately, achieve their business goals. Marketing consists of everything that a company does to identify customers’ needs (i.e., market research and consumer analysis) and ensure that products are designed to meet those needs. Marketers develop the benefits and features of products, including price and quality. They also decide on the best method of delivering products and the best means of promoting them to attract and keep customers. They manage relationships with customers and make customers aware of the organization’s desire and ability to satisfy their needs.

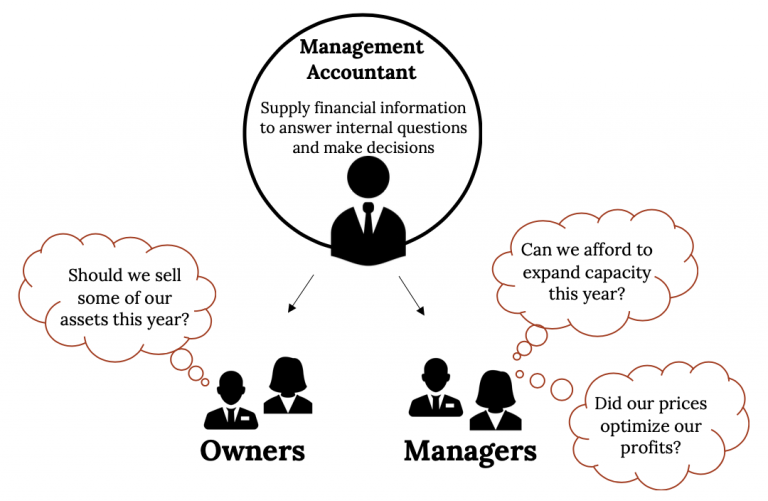

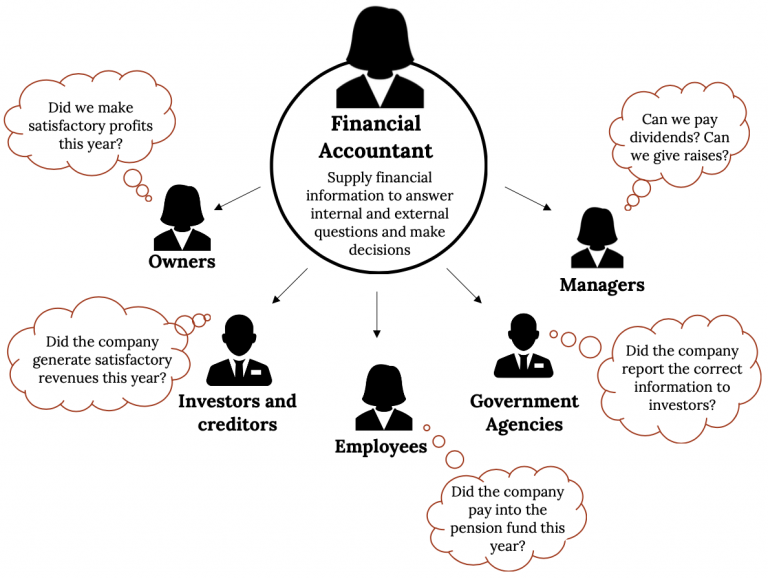

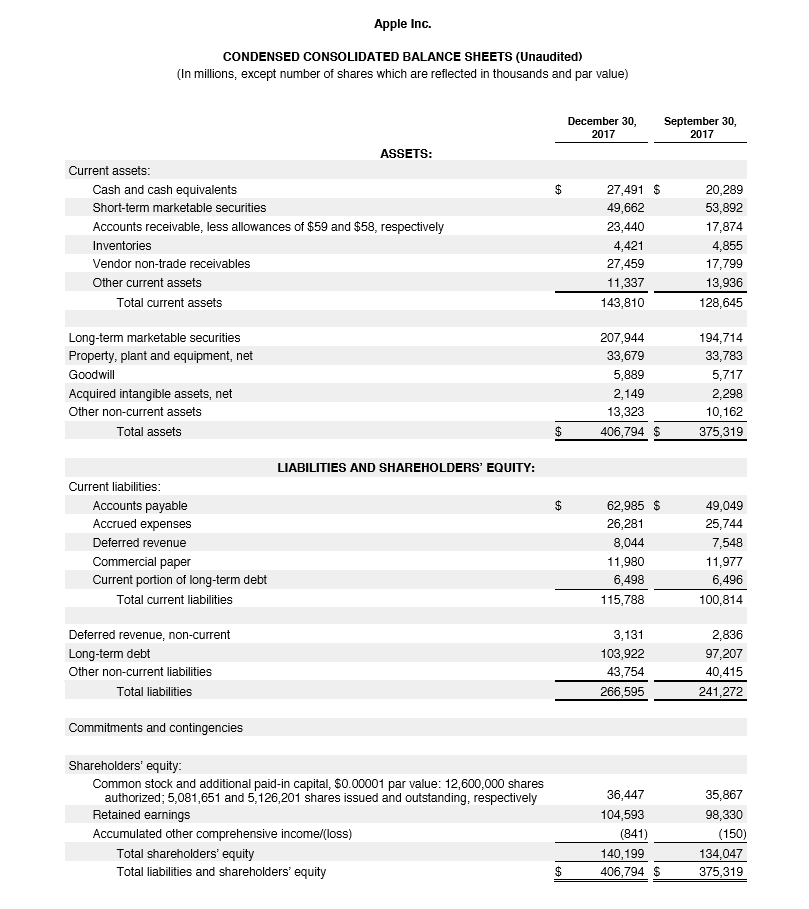

Accounting is the organizational function that is focused on recording, keeping, analyzing and communicating financial information. Managers need accurate, relevant and timely financial information, which is provided by accountants. Accountants measure, summarize, and communicate financial and managerial information and advise other managers on financial matters. There are two fields of accounting. Financial accountants prepare financial statements to help users, both inside and outside the organization, assess the financial strength of the company. Managerial accountants prepare information, such as reports on the cost of materials used in the production process, for internal use only.

The financial functional area of a business is responsible for managing the company’s financial resources, including budgeting, accounting, financial reporting, cash flow management, and investment decisions. Its role is to ensure the financial stability and growth of the organization by optimizing financial performance and minimizing risks. Finance involves planning for, obtaining, and managing a company’s funds while maintaining the financial health of the business.

Financial managers address such questions as:

Information technology is the organizational function that aims to understand the information and data needs of the company in terms of obtaining, analyzing, and protecting information. Information is one of the critical assets of most businesses. Businesses such as Facebook are entirely information-based businesses. Information technology (IT) managers are concerned with building computer and network infrastructure, implementing security and privacy protocols, and developing user interfaces and apps for customers. Usually, there is a high level of integration between the business’s website or application and other departments within the business, such as finance, marketing and operations. Often, businesses must develop interfaces to send and receive information from other companies, including suppliers, and logistics and shipping providers. The global pandemic has also made it necessary for businesses to establish and improve their virtual presences. As the use of technology increases so do the number of threats and vulnerabilities. The number of potential risks involved in using information technology is rising, creating a security gap between the expectations of users and the ability of technology suppliers to meet those expectations. Data privacy concerns, protection and security now play an important role. Cybersecurity is changing the way things are done today more than ever before.

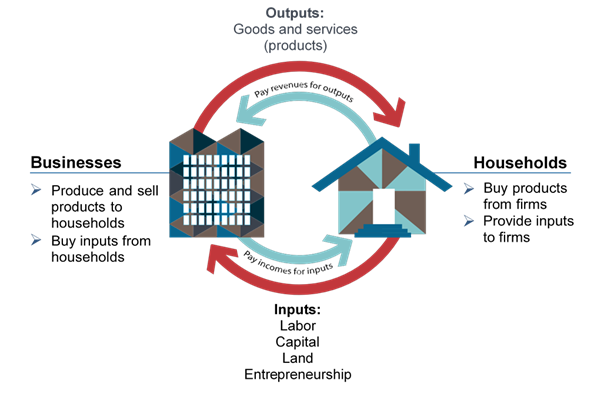

To provide goods and services, regardless of whether they operate in the for-profit or not-for-profit sector, organizations require inputs in the form of resources called factors of production. Four traditional factors of production are common to all productive activity: natural resources, labour (human resources), capital, and entrepreneurship. Many experts now include knowledge a fifth factor, acknowledging its key role in business success (Shown in Figure 2.3). By using the factors of production efficiently, a company can produce more goods and services with the same resources.

Commodities that are useful inputs in their natural state are known as natural resources and these can be either renewable or non-renewable. Renewable natural resources are those that can grow again or can never run out and these include trees, water, air, and sources of power like solar and wind energy. Non-renewable natural resources are found in the ground and there are limitations to their availability as they cannot be replaced or renewed. These include land, mineral and oil deposits. Sometimes natural resources are simply called land, although the term means more than just land. Companies use natural resources in different ways. International Paper Company uses wood pulp to make paper, and Pacific Gas & Electric Company may use water, oil, or coal to produce electricity. Today urban sprawl, pollution, and limited resources have raised questions about resource use. Conservationists, environmentalists, and government bodies are proposing laws to require land-use planning and resource conservation.

Labor, or human resources, refers to the economic contributions of people working with their minds and muscles. This input includes the talents of everyone—from a restaurant cook to a nuclear physicist—who performs the many tasks of manufacturing and selling goods and services.

The tools, machinery, equipment, and buildings used to produce goods and services and get them to the consumer are known as capital. Sometimes the term capital is also used to mean the money that buys machinery, factories, and other production and distribution facilities. However, because money itself produces nothing, it is not one of the basic inputs. Instead, it is a means of acquiring the inputs. Therefore, in this context, capital does not include money.

Entrepreneurs are the people who combine the inputs of natural resources, labor, and capital to produce goods or services with the intention of making a profit or accomplishing a not-for-profit goal. These people make the decisions that set the course for their businesses; they create products and production processes or develop services. Because they are not guaranteed a profit in return for their time and effort, they must be risk-takers. Of course, if their companies succeed, the rewards may be great. Today, many individuals want to start their own businesses. They are attracted by the opportunity to be their own boss and reap the financial rewards of a successful firm. Many start their first business from their dorm rooms, such as Mark Zuckerberg of Facebook, or while living at home, so their cost is almost zero. Entrepreneurs include people such as Microsoft cofounder Bill Gates, who was named the richest person in the world in 2017, as well as Google founders Sergey Brin and Larry Page. Many thousands of individuals have started companies that, while remaining small, make a major contribution to the U.S. economy.

A number of outstanding managers and noted academics are beginning to emphasize a fifth factor of production—knowledge. Knowledge refers to the combined talents and skills of the workforce and has become a primary driver of economic growth. Today’s competitive environment places a premium on knowledge and learning over physical resources.

The internal business environment in business refers to the elements within the organization that influence its operations and decision-making. It encompasses factors like the company’s culture, management practices, employees, and work processes. A manager should strive to create a well-managed or positive work environment within the organization. A well-managed internal environment has a significant role in influencing the organization’s operations and ensuring successful goal achievement. Some of the most important parts of the internal environment include communicating purpose to stakeholders through creating a mission statement (who we are, what we value), a vision statement (who we want to become), a strategy to achieve the company mission and vision and setting goals and objectives to gauge the company’s degree of success (refer to Figure 2.2).

These are the areas management has control over and can make changes to in response to strategic goals and changes that occur which impact the organization.

An internal business analysis is a business analysis conducted by management or by consultants to evaluate the company’s strengths and weaknesses. Such analyses are often closely associated with the SWOT analysis which helps businesses identify the company’s strengths, weaknesses, opportunities, and threats. An internal business analysis is generally more concerned with the strengths and weaknesses of a business, while its opportunities and vulnerabilities fall more under the external business analysis. When studying strengths and weaknesses, it is important to analyze them in light of their impact on customers, since the customer’s view of the company is ultimately the one that matters most. A SWOT analysis can be done on products, processes, companies, people, and just about anything you are trying to improve.

An internal analysis enables a firm to determine what it can do to improve internal capability to support the overall success of the business. There are other internal analysis managers can do to gauge how the company is performing, some of these include process mapping (to identify issues in processes), NOISE. SOAR, or SCORE analysis as alternatives to SWOT analysis; skills inventory tracking to determine what skills are missing or needed within the organization; succession planning to ensure employees are able to move into positions where someone else has retired; Gap Analysis, Core Competencies Analysis, OCAT, VRIO Analysis, Strategy Evaluation, McKinsey 7S Framework, etc. You will learn more about how managers analyze the business environments when you review the chapter on management.

Once complete, the organization should have a clear idea of where it’s excelling, where it’s doing okay, and where its current deficits and gaps are. The analysis gives management the knowledge to leverage the company’s strengths, expertise, and opportunities. It also enables management to develop strategies that mitigate threats and compensate for identified weaknesses and disadvantages.

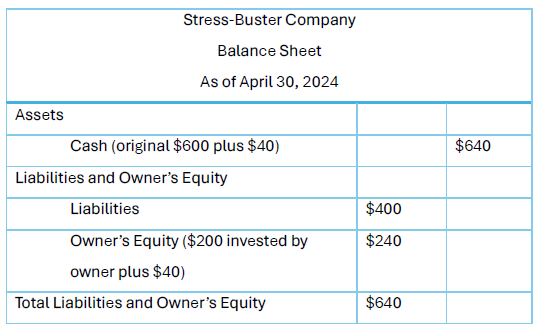

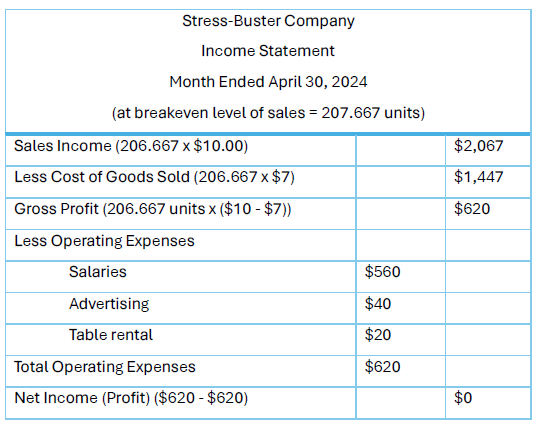

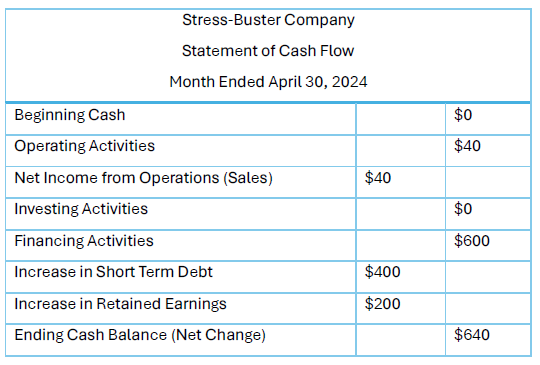

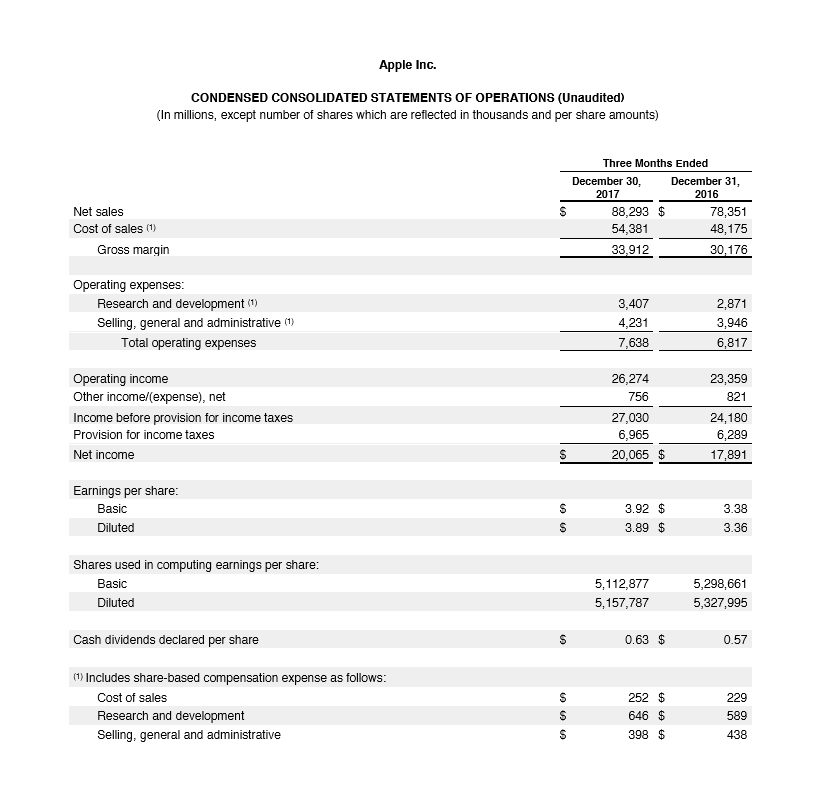

The micro-environment may be defined as including groups and organizations that have a direct relationship with the business. For example, suppliers, distributors, competitors, and external customers deal with the firm regularly and have a direct interest in the activities of the company because they are clearly affected by its actions (refer to Figure 2.4). It is important for any organization to monitor and analyze all elements of the micro-environment. The Porter’s Five Forces model is used for a thorough analysis of the competitive environment. A commonly used method for assessing suppliers is the Kraljic Matrix. A method often used when conducting consumer analysis is Ferrell’s 6W model. You will learn more about how managers analyze the business environments when you review the chapter on management.